The biggest promise in sport; UEFA's big RFP reveal; Tom Fox; MLS as World Super League, The Super League Six; The FA and England fans; Benny Hill’s producer; Making fortunes in silence

The newsletter of the podcast

P/E x MLS = Super League pt2

From this week’s conversation with Tom Fox, former Aston Villa CEO and president of the San Jose Earthquakes - UP 214.

Fox’s MLS hypothetical doesn’t sound all that hypothetical:

Let's take a hypothetical, the private equity group that was prepared to put all that money against The Super League. So let's say there's $4 billion out there. And someone comes in and says to Major League Soccer: give us your television rights on a global basis. Give us 25% of equity in your combined league. And over the next 10 years, we'll give you $4 billion with a requirement that money gets put into the player pool and gets spent on players. As a hypothetical, is that a model that some bankers sitting around a table would think makes some sense, because then I own the television rights I'm putting 400 million extra dollars into the player pool, so the quality on the field is going to get better. The value of the TV rights then goes up, so I'm actually putting my money into something that's raising the potential for my investment to become more valuable. And what you do is you then leapfrog the Mexican league, the Eredivisie, the Belgian league, the French league probably. You leapfrog every other league and you put yourself in the top two or three, in terms of your ability to compete with player salaries. Now you've then given up a percentage of equity on your business forever. But to do that, and then add more enterprise value, I think is a reasonable conversation

I’m wondering if this scenario is representative of the views within the ECA, which are pushing for more money from UEFA, see below.

Someone’s about to make the biggest promise in sports business history

UEFA will announce the winner of its big agency tender any day now.

In effect, they’re looking for someone - an agency, a private equity firm and/or a mix of both - to guarantee them €3.7billion income a year for three (or six) years.

Unverifiable claim coming up: This represents the biggest ever rights guarantee for a sports property by an agency.

So, WTF?

The tedious small print: Uefa Club Competitions SA (UCCSA) is new joint venture between Uefa and the European Clubs Association (ECA) created after the 48 hour Super League snafu earlier in the year.

UCCSA issued an RFP in October, giving just four weeks for interested parties to respond by November 15th. This week, the key decision makers met to decide.

The RFP invited interested companies to make offers across either a three- or six-season period – either from 2024-25 to 2026-27, or via two separate offers (from 2024-25 to 2026-27 and 2027-28 to 2029-30) – to sell rights to the Uefa Champions League, Europa League, Europa Conference League, Super Cup and Youth League.

Why is it interesting?

The nature of the responses to UEFA’s rfp tell us something about the ongoing relationship between sport and money, and is a test of some of the fashionable sportsbiz abstractions - role of p/e, future rights values, ownership stakes, private/public collaboration.

What’s really happening?

TEAM Marketing has been the incumbent since the inception of the UEFA Champions League in 1992, creating and then iterating one of the most commercially successful models in sport, much copied but rarely bettered. (UP 45 The Champions League Model)

The decision to issue a tender fell out of the post-Super League bunfight, as the big clubs sought to get more money from UEFA via the UCL.

The final decision will be made by UEFA President Alexandr Ceferin and the UEFA Executive Committee. The end of December was referenced as a decision point, and there was an assessment meeting over the past week.

This is where it gets simultaneously simple and complex.

The simple bit is: the clubs want more money.

There’s a niggling feeling within the ECA brigade that UEFA + TEAM has left money on the table, that the relationship has grown cosy and complacent due to lack of supply side competition.

And the numbers are scary, even for p/e.

In effect, the short timescale laid out in the tender means the bidders were given just over four weeks to raise a guarantee against €3.6bn of revenue per season, which is the number that the big clubs (ECA) believe can be achieved, and which represents a 12.5% increase on the €3.2bn currently delivered by TEAM for the 2018-21 cycle.

What does this mean?

One word: risk.

Most people reading this newsletter will be familiar with that sense of lingering self loathing that comes in those few short hours between winning a pitch and the cold water realisation of having to actually deliver on it.

Take those feels and add the weight of having to deliver three and half billion quid, every year for three (or six) years.

To really understand what’s going on here we need to unpick the rights guarantee process, which is the reality that sits behind The Biggest Promise Ever Made (TBPEM).

One UP source explained it like this: “A bank guarantee is normally rolling - so you agree that you take a guarantee for 1 year - and then it automatically rolls over”.

The big worry for the lender is an ISL-type endpoint where the agency over promises at the front then fails to make the money back on the sales side and so collapses under the weight of the guarantee. (The end of ISL: UP 164).

This means the details of the bank guarantee are critical as the cost of financing the borrowing can vary widely and can escalate quickly.

And then you layer in inflation, which is likely to make any investment decision more complex over the duration of this deal.

By contrast, TEAM has never formally guaranteed UEFA a number in this way, but works on retainer plus commission on sales, which is thought to make €15m-20m a year for the agency.

So, who’s in the running?

TEAM are back in. As are IMG and Infront. Sportfive decided not to bid.

So far so obvious.

But what is an agency in this context?

When the tender was announced, there was much talk of it being a siren call to the private equity firms who clustered around the Serie A media rights tender earlier in the year.

But UEFA is not offering an equity stake, which is p/e’s usual game.

(See Tom Fox’s MLS hypothetical above on the balance between short term gain for longer term dilution of control).

Questions Questions

So, will it be a hybrid offer, with agencies working as the front for p/e or another source of finance, given many of the big agencies are in bed with p/e anyway?

Other questions are more prosaic and relate to personnel: How much influence does Nasser Al-Khelaifi hold over the decision? As chair of ECA, UEFA Exco member, owner of PSG and chair of BeIN Sports, the Qatari is both seller and buyer in this process.

One UP source said: “TEAM do a good job. They could be more aggressive if they didnt have to answer to UEFA, which is where the clubs feel the money is most inefficient. So the CVC-type model, where the money comes with menace and aggressive commercial decision making, might yield more”.

And then the real kicker:

“But does UEFA want to have p/e bossing them around as well as the ECA?”

Another source told me that there’s been a guarantee offer but not one big enough to land a knockout blow to the status quo.

So, TEAM’s argument - be careful what you wish for - is set against The Biggest Promise Ever Made.

For UEFA though, this feels more than just another agency tender. It’s about power.

UP source: “Collectively ECA clubs would like to sell the rights themselves and/or claw back rights themselves from the centre. So the tussle is in part existential for UEFA and in part about whether differences are best settled by promises of more money”.

We’ll see.

Meanwhile, six PR agencies got paid for launching The 48 hour Super League

Think about that next time you get imposter syndrome.

Good story from David Hellier at Bloomberg.

For the record the Super six were:

InHouse, Paloma, Verini (Italy), NoCom, Bunhill and Opinion Way.

Me neither.

The wrong type of fans

The FA’s relationship with England fans reminds me of the Labour Party’s view of voters.

Working theory: I suspect that the people running football don’t really like football fans, in the same way as the leadership of the Labour Party doesn’t really like working class people, aka their core voters.

The report in to the battle of Wembley Way, also known as the Euro 2020 final, was a tale of them and us. But the violent idiots are same people who appear as customers in the data. They buy the shirts and - sometimes - the tickets.

But they’re not the right kind of fans.

My mind goes to election night in 2019, and this clash between former Home Secretary Alan Johnson and Jon Lannsman, the leader of Momentum, the Corbyn supporting group within the Labour Party.

‘Working class people have always been a disappointment to people like Jon’.

My point is that there’s a problem when a business is producing something for people they don’t like.

Btw, I once had this conversation with the producer of The Benny Hill Show, who really, really loved The Benny Hill Show.

‘The problem with so much of what the BBC produces’, he said, ‘was that they make programmes they wouldn’t themselves watch. They’re guessing. And making mistakes.’

I’ve come to think this is the biggest question relating to any creative (or sporting) output:

Does the producer watch?

Dealing with China: Quiet diplomacy vs making a fortune in silence

The geopolitics of sport is confusing, who knew?

Two weeks ago, Seb Coe was all quiet diplomacy, bilateral backchannels and Smiley’s People when it came to Peng Shuai.

This week, China’s Vice President Xie said the business community cannot expect to ‘make a fortune in silence’, calling for company CEOs to ‘speak up and speak out, and push the US government to pursue a rational and pragmatic policy towards China…It’s good to enjoy the shade under the big tree”.

Presumably Xie’s definition of the business community includes the sports business community.

Don’t put your child on the stage Frankie Worthington is nearly a great heading, part 2

Mentioned in a previous UP newsletter, relating to Sky Brown the 13 year old skateboarder at the Tokyo Olympics.

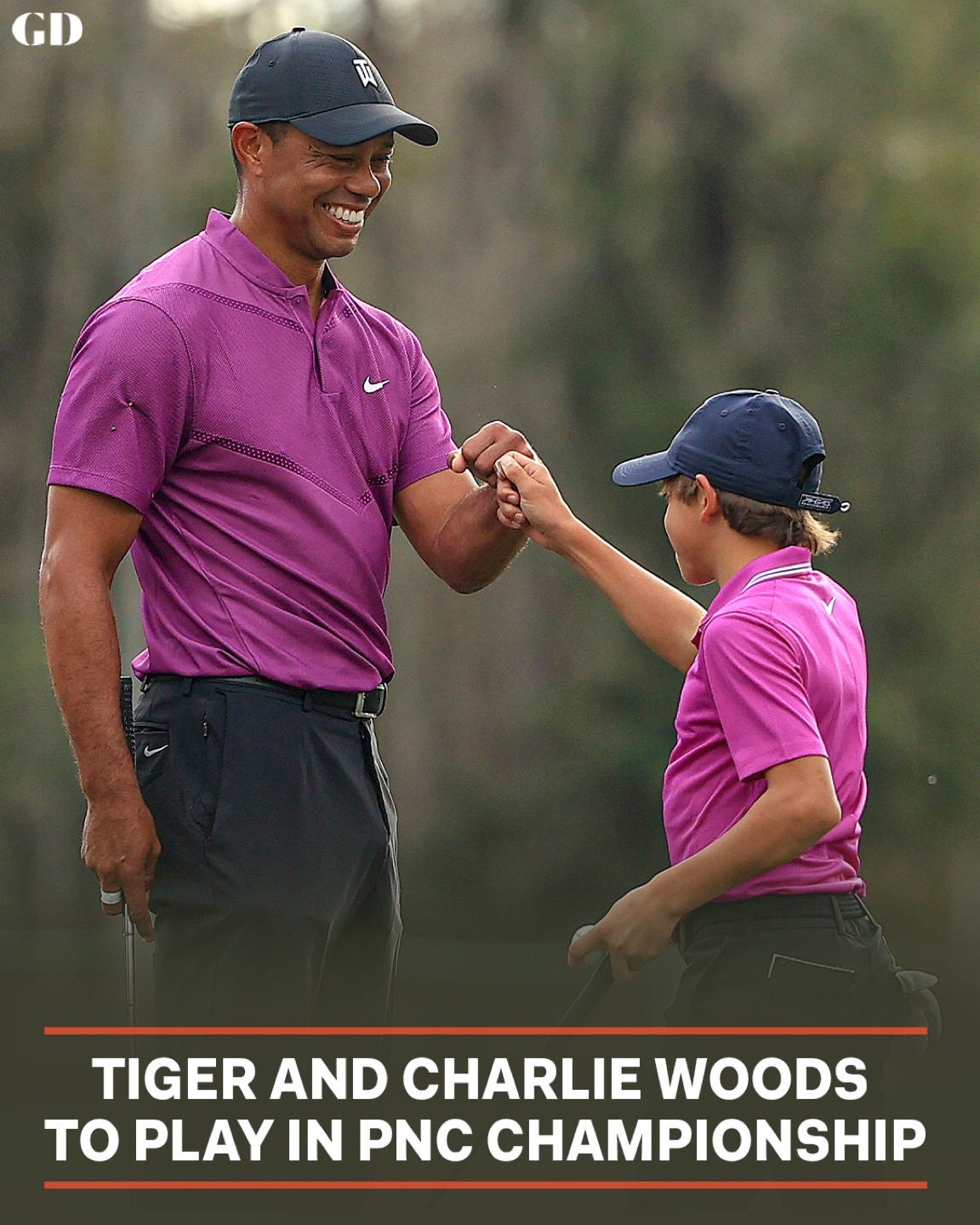

This week, Tiger’s 13 year old son Charlie is the centre of attention.

My worry is that Charlie Woods is a media studies case study in waiting.

I’m with Lee Westwood, who called this out last year.