That Girl Didn't; George Osborne's 2012 legacy; A British Title IX; The Musk of OPM; UP the Arsenal; OneFootball's Series D raise; Goldman's shovels; Bratches and the meaning of LIV;

The newsletter of the podcast

A brand new channel for your sponsors.

This week's UP newsletter is sponsored by our friends at Voiceworks.

Podcast advertising is one of the most effective forms of marketing communication, offering better recall and impact than video. The Global podcast advertising market is worth over $8bn – set to rise to $38bn by 2026 (IMARC).

Voiceworks Sport can develop an audio strategy that works for you and your partners creating great engaging content and brand new revenue streams.

That Girl Didn’t

Criticising This Girl Can is like beating up Judi Dench.

So this isn’t that.

It’s more a question of what This Girl Can reveals: about how government really works and why it doesn’t; the unglamorous slog of public policy reform; the role and limitations of sports marketing and the decade long battle over the participation legacy of London 2012.

What happened?

Baroness Sue Campbell of Loughborough is the star turn in this week’s podcast UP241, the latest in our Re:Thinking Sport series with Portas Consulting.

The topic is girls participation in sport.

The subtitle could be, why are we still talking about this?

You’ll hear on the recording that I start the conversation with an facetious comment along the lines of, ‘I thought this problem had been solved’, referencing This Girl Can, the multi-award winning marketing campaign aimed at getting girls to do more sport and activity.

Baroness Campbell interrupts me, holding up a finger and thumb, like a chef holding an Oxo cube:

‘And with about that much impact, but anyway, go on’

So, here we have two of sport’s great national treasures, one questioning the efficacy of the other.

If anyone should know what’s gone wrong it’s Sue Campbell, who’s been at the epicentre of the sports participation question for five decades, a PE teacher who ran UK Sport running in to and out of London 2012, and is now Director of Women’s Football at The FA.

Alternative histories

There’s a simple answer as to why girls still lag behind boys when it comes to doing sport: money.

And a more complicated one, involving people, politics, narrative fallacy and blame attribution.

The truth probably lies somewhere within the following three plot lines:

Story 1: The inspiration narrative

Boosted by National Lottery funding, a generation of brilliant women athletes used London 2012 to inspire a generation of girls to take up sport. This Girl Can builds on this legacy.

Story 2: Austerity’s terrible legacy

A year before London 2012, George Osbourne and David Cameron began dismantling sport provision in state schools, under the guise of post-financial crash austerity measures. This act of social vandalism undermined any pretensions of an Olympic participation legacy. This Girl Can is a sticking plaster.

(NB: ‘Austerity’ was always a cynical political choice, not an economic necessity).

Story 3: The Lottery funding was wasted on buying medals

The National Lottery was a once in a lifetime opportunity to solve the girls and sport problem. Billions were spent, with much going to the top of the pyramid, on Team GB high performance programmes - a prerequisite of the ‘Inspire a generation’ strategy. A generation of sports administrators prioritised podium success, encouraged by the new Tony Blair government and the outcry over Team GB’s one gold medal at Atlanta in 1996.

See also: Baroness Tanni Grey Thompson (UP224) on the ‘false hopes’ of London 2012.

Britain had This Girl Can. America had Title IX

One is a (very good) marketing campaign, the other is an enduring political solution.

The end of the podcast asks, what would a British Title IX look like?

Here’s the timeline:

2mins:03secs What was the real impact of This Girl Can?

2:57 The latest Women In Sport Report

3:29 'Girls have 25 minutes less opportunity to take part in primary school sport compared to boys'

4:35 50 years of hard slog

7:17 When a non-political adviser becomes a political adviser

7:42 Tony Blair's request

16:17 Buying gold medals?

17:40 'It's a disgrace that anyone should use that term'

21:00 The 2012 legacy; do major events over promise?

22:21 'We dismantled a world-class school sport system a year before London 2012'

31:34 The lessons of Park Run for NGBs

42:05 A British Title IX?

Hear the whole thing here #HearHere

See also: Sport England’s Active Lives survey is out today. Here’s chief strategy officer Nick Pontefract’s summarising thread.

UP, Arsenal - insert lewd headline here

Hear here: UP240 : Juliet Slot, Arsenal’s chief commercial officer and Dan Gaunt of Turnstile discuss football sponsorship, what clubs are and aren’t selling, intangible value, No More Red and why the media measurement industry has failed women’s football.

See also Dan Gaunt’s keynote at SportsPro Live this week on the value of the Chelsea shirt:

Turnstile estimated that access to Chelsea’s IP would be worth UK£18.8 million (US$23.8 million) to a potential sponsor, with exposure amounting to UK£22.2 million (US$28.2 million) and benefits UK£2.3 million (US$2.9 million), giving a final total of UK£43.4 million.

Gaunt emphasised that Turnstile had made some “estimated assumptions” about some data inputs and what would be included in the rights package on offer, which it modelled based on similar deals across the Premier League.

“Our view is that the last 20 years, the industry has become a little bit obsessed with tracking and measuring logos and trying to quantify the value of those logos,” said Gaunt. “I think we all know that’s an important part of sponsorship, but it’s not the field.

“You only need to look at examples like the NFL, the Olympics, that offer very little involved exposure but are demanding significant rights fees from their partners around that value of association that they give to them.”

Spat of the Week

Andy Holt owner of Accrington Stanley (UP195) v Nick De Marco, (Sports lawyer “QC that really packs a punch”- Tyson Fury).

The Musk of Other People’s Money

It’s impossible to read about Elon Musk’s leveraged buy out and not think about the Glazers and Man Utd. Twitter shares a characteristic with a football club: they both appear at least, to occupy the ground between private and public good.

Musk says he’s pledging $21 billion of his own money and will presumably sell a chunk of Tesla stock to raise those funds. Banks are going to lend him $12.5 billion, secured by an additional $62.5 billion of his Tesla shares. The rest of the purchase price and other costs will be funded by $13 billion in debt that Twitter will take on….Twitter will have about $1 billion in interest payments due annually. Maybe that will be manageable? It’s a close call. Twitter’s cash flows (the money it hauls in before accounting for interest, taxes, depreciation and amortization) are projected to be about $1.43 billion this year and $1.85 billion in 2023. So debt payments will consume a huge chunk of Twitter’s cash. Homeowners underwater on a big mortgage and related interest payments will be able to sympathize with the financial corner in which Musk may be putting Twitter. Musk is going to have about $1 billion in interest payments to make, too, and if Tesla’s shares hit rough waters he could get squeezed, but let’s leave his wallet out of the mix for now. Twitter itself is going to have to churn at full throttle to earn the kind of money it needs to be both profitable and self-sufficient.

See also: I interviewed William Cohan for The Irish Times fifteen years ago. He was a journalist who became a successful Wall Street banker, spending six years at Lazard before going on to be managing director of JP Morgan Chase.

I rate him as the best business writer out there. He’s joined up to launch a new thing called Puck. Worth checking out.

Bundle, Unbundle…Joining the dots UP Stream

Tomorrow’s podcast is with Dave Roberts, the key architect of FIFA+, the global governing body’s D2C streaming play.

If fans think the football streaming market is confusing at the retail end, they should have a look under the bonnet.

Some of the back office of FIFA+ is based on MyCujoo, a content aggregation platform bought by Eleven Sports. Eleven is part of Acer Ventures, owned by Andrea Radrizzani, founder of Media Partners, which became MP & Silva, whose COO was Peter Hutton who is now head of sport at Meta and in February became a non-exec director back at Eleven, which was run for a while by Luis Vicente, who was formerly FIFA’s head of digital transformation.

Radrizzani also owns Leeds Utd and has a stake in another major football streamer - OneFootball - which bought Dugout, whose owners included some of the biggest clubs in world soccer including Real Madrid, Barcelona and Chelsea.

This morning, OneFootball announced they’d raised $300million Series D funding, the comms around which goes big on all things blockchain, web3 and metaverse.

Here’s founder Lucas von Cranach on the what and why.

Meanwhile, for fans seeking more niche football content, UEFA just did a deal with Viaplay, about which Bundle regular Charlie Boss makes two salient points.

Job of the Week

The Job: WeAreFearless are looking for a Sports Savvy Creative.

The Blurb: You could be a writer, art director or hybrid creative - The most important thing is that you’re great at coming up with ideas that both clients and sports fans love.

Help us unlock opportunities to engage audiences with fun, thought provoking and behaviour changing campaigns, whether that’s through an experience, content, partnerships, PR, innovative use of tech or something completely new.

This role presents fantastic opportunities to make a difference across all levels of the agency, working with many of the sports world’s most respected brands.

The Link: To apply or for more information email Jemma@wearefearless.com

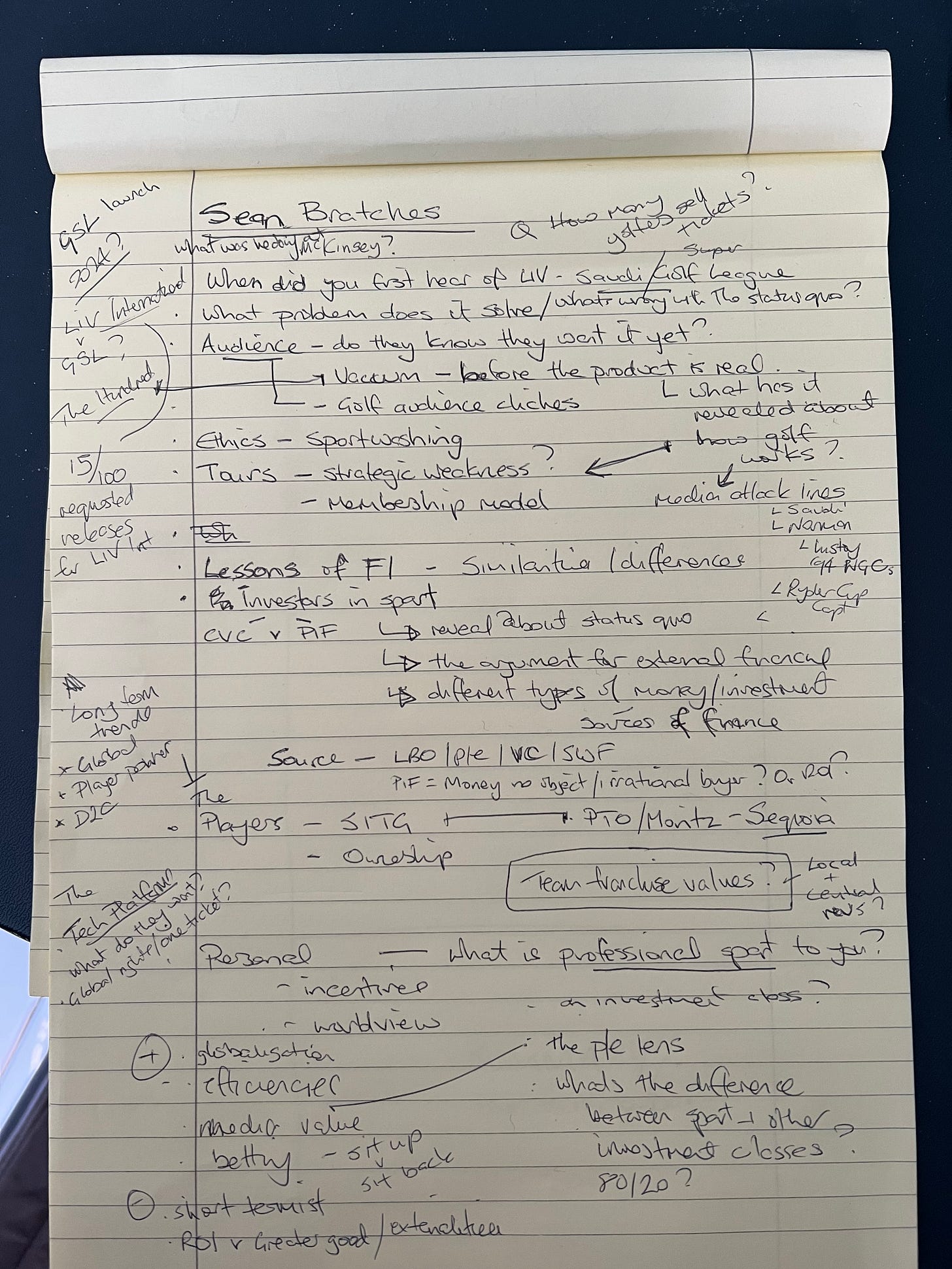

UP Coming - Sean Bratches

Bratches wants to disrupt golf.

The ESPN and F1 veteran comes on the UP podcast to talk about golf, money, team brands and media attack lines. Whether you care about golf or not, you’ll want to hear it.

LIV Golf is a story that brings all the current sports business threads together.