17 ways to sound clever in a web3 conversation; Sport betting's mega-CAC; Metaverse as Brexit; Top Shot's plumbing legacy; Beware the licensing frame; Ryan Reynolds' sales deck; When Pizza Hut ruled

Overthinking the sports business, for money

This week’s podcast is Web3 WTF - Sillytuna x Sporting Crypto, and it’s a primer for our live event, Wise UP - The Unofficial Partner Web3 Brainstorm in Unofficial Partnership with Arsenal Football Club.

Doors open at 5.30pm on September 21st at The Emirates Stadium in London. There’s a rumour of an after party, details to come.

And did you see who just bought a ticket?

The Premier League, Liverpool FC, Sky, IMG, Two Circles, Rarible, Brentford FC, Aphetor, M&C Saatchi Sport and Entertainment, Voiceworks, Deltatre, PGA Tour, FUSE, Arena Racing, Nielsen Sports, Portas Consulting, Fan Curve, YouGov Sports, CSM, Twenty First Group, 1920 Worldwide, Prism Sport + Entertainment…many, many others.

If you’re quick, you can join them by pressing this gif.

Our aspiration for the event is three fold:

Have fun. Learn something. Meet people.

The middle bit is where I’m currently spending my time.

So the following is me thinking aloud after this week’s pod with Alex Amsel (@Sillytuna) and Pet Betrisha (Sporting Crypto).

17 things to think about when preparing to attend a web3 brainstorm with people who actually know what they’re talking about

NKE - The only thing we know for sure about web3 is that Nobody Knows Everything. For us laggards there are glimpses, fragments, signals that may or may not be the road map.

Beware evangelists. There’s a fundamentalist web3 wing pursuing a purist metaverse. Their talk of utopia and sunny uplands sound a bit like John Redwood’s wank dreams of a hard Brexit.

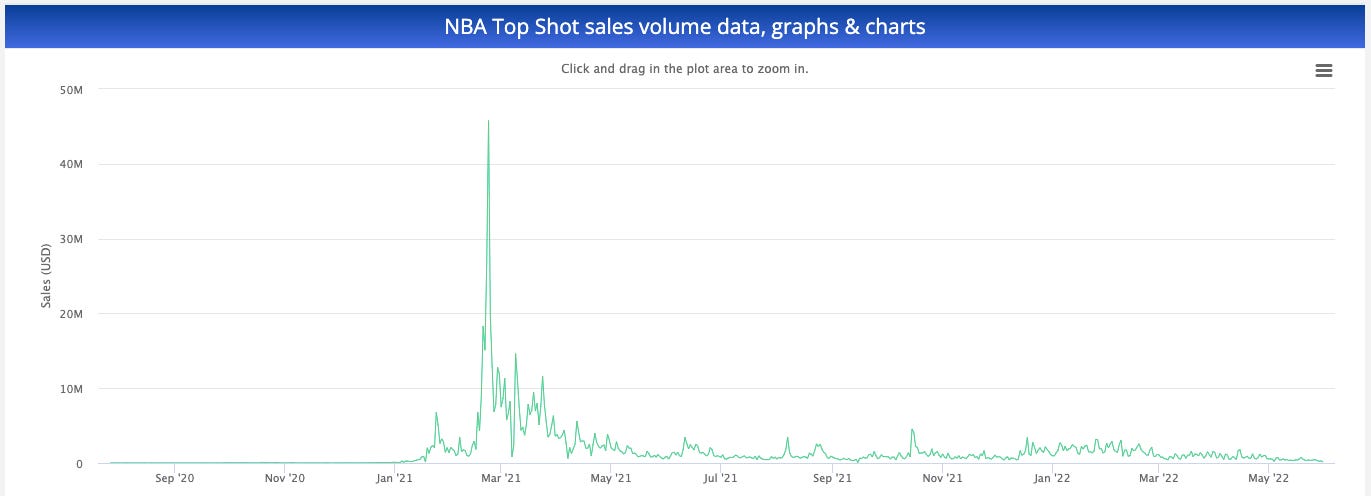

Is NBA Top Shot a reliable proof of concept? Top Shot is a blockchain-based virtual trading card platform designed by Dapper Labs in partnership with the NBA and NBA Players Association (this last bit is relevant as it encouraged the superstars to become evangelists for their own collections, at least initially - see graph below).

On one day in February 2021, Top Shot generated over $45million in trading revenue and $224million in sales volume from 80,000 unique buyers. But a year is a very long time in NFT circles. See graph.

6. This chart is part of the problem: It frames Top Shot as a financial story. Immediately we look at the Feb ‘21 peak and compare to now. Boom and bust. FOMO and FUD market cycles. Within the macro there’s thousands of individual people with stories to share, a few happy winners and many, many losers.

7. The result is sport as pork futures, memories as a tradable commodity, with NFTs as the bad guy and ‘Web3’ as a financial tool. This is a partial framing of the new, new thing and is getting in the way, underplaying the role blockchain and web3 can play in building open, sustainable and, whisper it, HUGELY FUN worlds. But meanwhile…

8. ‘I want one of those’ - every major rights holder, from teams to leagues to federations, saw Top Shot - or specifically, the money it was making for the NBA - and sought to move towards its own iteration. Pet Betrisha notes the numbers around one newsworthy recent NFT launch: “Liverpool’s NFT drop target was 200,000 people, and actually reached 10,000”.

9. Dapper as plumber: Top Shot is built on Dapper Labs’ Flow blockchain infrastructure. They are one of a few companies selling shovels in a gold rush - good for them - and the NBA experience has opened doors to the NFL, La Liga and - if the rumours are true - the Premier League, where they will likely reiterate versions of Top Shot, with ‘varying degrees of success depending on how entrenched the collecting culture within those sports’ according to Pet Betrisha on the podcast.

10. Dapper won plaudits for its onboarding process because it tackled one of the key problems with this world, which is that it’s so fucking tediously difficult to understand and engage with.

Dapper/Flow made it easy for muggles to sign up to Top Shot and start building a collection. All they needed was a credit card. Compare this to Socios, where fans need a degree in physics and a packet of Solpadeine to get to the start line.

(Btw, Top Shot Off boarding - aka getting out with your money intact - is a whole other question, a point made by Alex Amsel on the pod).

11. The C Word: Beyond the techie UX stuff, there’s a deeper problem when it comes to Big Sport’s Web3 Adventure. That problem has a name: it’s called PEOPLE.

You’d be hard pressed to find two more disparate cultures than Big Sport and the futurist web3 techie nerds, many of whom spent their school years being wedgied by the jocks they’re now trying to sell the future to.

12. The cigarette smoke in pubs

You’ll have your own definition of shared cultures, but I liked this quote:

Culture is like cigarette smoke in pubs before the ban….it’s there in tropes and cliches, precedent and the dread line ‘just how we’ve always done it’.

The sports business culture is unapologetically commercial, and becoming more so with every passing p/e deal.

Those same commercial instincts are what’s created the gravy train upon which we all ride to varying degrees of success; to the above quote, sales culture is the ‘cigarette smoke’ we all breathe.

This leads us to:

13. The licensing frame: When presented with a new challenge, sport’s first instinct is to try and monetise it.

The current Football-meets-NFT snafu is due to commercial teams trying to shove anything labelled web3, blockchain or crypto in to sponsorship license-shaped hole.

This licensing frame closes down routes to creative collaboration which is a necessary hallmark of ground-up web3 community building. For this reason sport is often a less vibrant, slower, less nimble and less interesting forum for creativity than other spheres such as fashion, music or the arts.

14. Deal terms have an end date. FIFA has partnered with Algorand; Man Utd with Tezos, and so on. Each of these multi year deals outsources the blockchain question to third party vendors in return for short term cash. But it sets up a longer term problem, for some future regime to deal with. What web3 real estate have they given away, and how tied to a specific tech vendor are they? This is more complex than stadium pouring rights or a kit deal. How easy is it to swap out of one vendor’s blockchain on to another?

Alex Amsel: Don’t annoy your own most loyal fans by switching up the platform from beneath them every three years because the commercial team’s done a new deal with the next blockchain vendor on the rank.

15. Alternatively, make your season ticket an NFT and see what happens

To illustrate, yesterday’s Ticketmaster-Dapper announcement feels directional.

See also: UP258 The Ticket Problem: why tickets are the best indicator of a team’s relationship with the future.

16. The Metaverse: What It Is, Where to Find it, and Who Will Build It

I’m reading Matthew Ball’s new book as homework for the live event. Good so far, will report back when I’m finished.

There’s a bit in this interview with Tyler Cowan that ties some threads together well.

Matthew Ball: There’s currently this ethos, especially in the Web3 community, that decentralization needs to win and that decentralization can win.

It’s a question of where on the spectrum are we? The early internet was obviously held back by heavy decentralization. This is one of the reasons why AOL was, for so many people, the primary onboarding experience. It was easy, cohesive, visual, vertically integrated down to the software, the browser experience, and so forth. But we believe that the last 15 years has been too centralized.

At the end of the day, no matter how decentralized the underlying protocols of the metaverse are, no matter how popular blockchains are, there are multiple forms of centralization. Habit is powerful. Brand is powerful — the associated trust, intellectual property, the fundamental feedback loops of revenue and scale that drive better product investment for more engineers.

So I struggle to imagine the future isn’t some form of today, a handful of varyingly horizontal-vertical software and hardware-based platforms that have disproportionate share and even more influence. But that doesn’t mean that they’re going to be as powerful as today.

17. Then add money. Todd Boehly’s guide to fan tokens

New Chelsea owner Boehly spoke with 80s junk bond king Michael Milken.

When asked about the role NFTs and “tokenization” might play in future asset management, Boehly used sport as context.

“You’re just characterizing it as ‘tokenization’ because it’s digital. But the reality is ... if you want to buy stock in the Green Bay Packers, that to me is ‘tokenization’. You have no rights, you have no control, but you can say you have an ‘interest’ in the Packers.

“I think loyalty programs, whether it’s Vivid Seats, Dodgers, Lakers, Chelsea, we’re all thinking about how do we have direct customer relationships that we can then build upon. And if a form of that comes in a ‘tokenization’, then so be it, but what we really care about is direct access to our fanbase.

“And if we have direct access to our fanbase, [then] we can start thinking about [having] lots of tiers of different fans that want different products. So we’re starting to think a lot about what is that we want to really give our ‘super fans’ and how do we develop fans.”

Betting’s CAC is some strong CAC

Good piece on the US sports betting market.

A company can measure its marketing performance based on customer acquisition cost (CAC) and lifetime value (LTV). If the cost to bring in the customer is higher than the average monetary value they will eventually bring to the company, it’s a bad investment.

For example, in a 2020 report, DraftKings’ average CAC was $371 and its LTV was $2,500. For context, a 3x LTV-to-CAC ratio is considered good for software companies — DraftKings’ ratio more than doubled that.

Leaders x UP = Happiness

Leaders Week London returns at the slightly earlier than usual date of 26th-29th September 2022. Over 70% of LW LDN attendees are at Director level or above. From the Premier League to WWE, BT Sport to DP World Tour, they’ll all be there this September. In addition to the talks going on across three stages, there’s networking breakfasts, forums (like the Brand and Sponsorship Forum), think tanks (the Broadcast Disruptors Think Tank for example), tech showcases on the exhibition floor and the list goes on – you can tailor your Leaders Week London experience to best suit you.

The two day Summit, part of Leaders Week, will be held at Twickenham Stadium on 28th and 29th September. Even better, you can use UP15 for a 15% discount on your Summit passes. Visit leadersinsport.com/UP for more information.

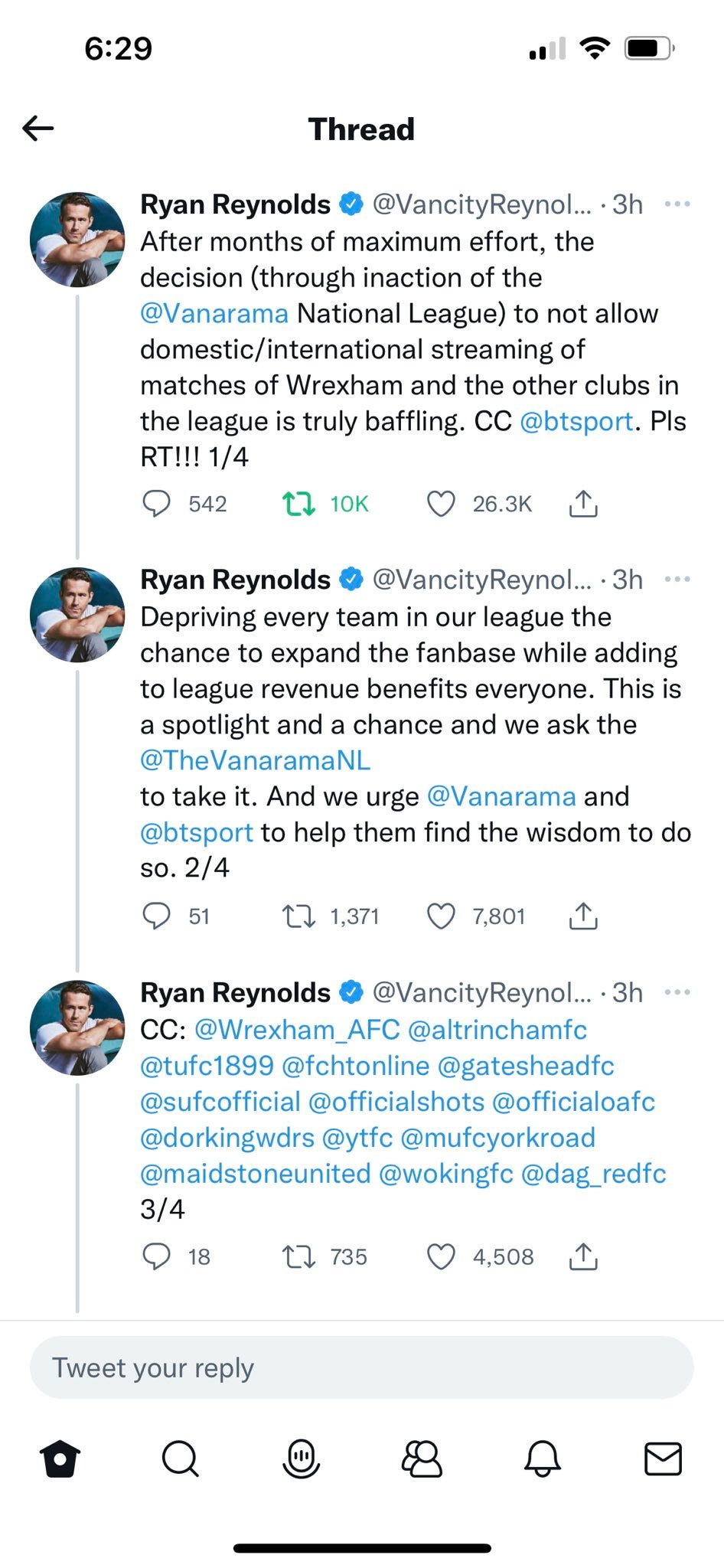

Ryan Reynolds, sports media rights negotiator

What’s the value of Wrexham’s streaming rights today? How will the Ryan Reynolds story and documentary add to the entirety of the National League’s value in say, the US?

Be fun to put some numbers to these questions.

When pizza ads were great

TMW a Pizza Hut ad makes you consider the wasted opportunity of post-Soviet Russia, and then you remember they did that one with Waddle, Pearce and Southgate after Euro 96.