A bet too far for ESPN; Double dipping in the agency market; Open and shut case for WSL; Palpable buzz; Cowboy consultants and coasting clubs; Silly likes

Overthinking the sports business, for money

We told you not to bet on ESPN Bet

See podcast from 2023:

What happened?

This week Penn Entertainment’s interactive division announced that it lost $110million in the final quarter of 2024. This is the bit that contains ESPN Bet, the company formed after a $2billion deal to buy the license of what was previously Barstool’s sports book, in 2023.

In the 20 US sports betting jurisdictions in which it operates, ESPN Bet’s market share remains under 3%.

Disney, which owns ESPN, was always worried about the optics of taking Mickey Mouse in to gamblng. But they thought the money was too much of a lure and the ESPN brand was too big to fail.

Now? Less so.

Why do we care?

This is a story we’ve stayed close to, mainly via Sam Sadi, CEO of LiveScore, who has appeared on several of our podcasts and was a star turn at our Convergence Brainstorm event at Olympic Park in September 2023.

This week I revisited the live podcast recorded on that night in 2023.

Given the deal was only days old, Sam Sadi, and Mike Falconer of Sportradar, were remarkably prescient:

Unofficial Partner: If I'm Penn why did Barstool not work and why do they think ESPN will work?

Sam Sadi, LiveScore: Quite simple. Barstool audiences and users were asked to downgrade their sports betting experience and use an inferior sports book product that they were used to.

And for the same reason, ESPN bet will likely not work because ESPN users will be asked to switch from DraftKings and FanDuel, which provides exceptional products and services, to a sportsbook that's been built in the last year, pretty much. And I know I'm exaggerating a little bit and dramatizing, but, we've seen so many examples in the past in Europe where tremendous media brands have tried to use their audience and inventory to launch their, licensed branded sports books.

And, it's incredible that they failed to see that. If their audience is used to you know betting at the top sportsbook in their territory in their country Why would they switch to something inferior just because they're watching that logo on the screen or they're reading that newspaper with that brand and that that's the pressure, that you need to be able to deliver that world class sports betting experience.

Unofficial Partner: So why? Again talking as a non better, it feels like a brand versus product question, I think.

Mike Falconer, Sportradar: You being a non better is the key question for ESPN. I think what they have to have assumed is that because of the strength of their brand, they are better placed to convert those people that aren't betting currently in the US than a sports book. Because they start with, heavy media consumers, heavy sports interested consumers. For me, I think the only basis on which ESPN could be competitive would be if they changed the whole betting experience. And actually the betting experience is in the media environment. So in fact actually the brand that's facilitating it is less important. It's the way you can actually transact. So through ESPN and their content, if you can bring the bet to the content, and of course I think it takes the actual operator brand out of the question to some extent, by and large.

But I think ESPN have no chance as you say, to challenge the duopoly unless they can broaden the adoption rates way beyond where they are now in the US.

The full podcast is here:

ESPN Bet is a bet on brand over product, and it’s losing

The betting convergence argument sees gambling not as part of the business model, but rather, THE business model.

The theory is that convergence of sports media and gambling solves two separate macro problems in two multi billion dollar industries:

The decline of the classic television bundle.

The subscription model is breaking before our eyes. (There’s a podcast for that btw). The sports media industry’s answer to this problem seems to be, ‘More Channels, More Subscriptions’.

Let’s see how that turns out.

Oversupply in the betting market

Likewise, punters are swamped with undifferentiated sports book product.

As the ESPN Bet story seems to show, at the retail end, the cost of building a differentiated betting brand is enormous.

And when you get there, the reward is 2 and a bit percent market share.

Sam Sadi: If you were to launch a new sports book brand into the UK market today, it would take you maybe 10 years to get 1% to 2% market share and you would've spent like £200, £300 million in marketing. And I'm not sure if you would succeed. This is assuming that you've built a world class sports book and we see many examples of, you know, large companies coming in and only gaining one to 2% market share after many years of investment. So to succeed now in today's online gambling industry, you need a different business model.

So, convergence, gambling firms bidding for TV rights, Betting Shop as Sky Sports

Which gets to questions of plumbing.

Is it quicker, easier or cheaper to build a sports book within a media property or, build a sports media retail front on top of a betting shop?

Convergence means seamless integration of betting in to the viewing experience. How easy is this to achieve, in reality?

The revenue flow from sports and betting events suggests the majority of betting is narrative-based, and in large part driven by the player feeling they have superior knowledge of their team than the house.

So, can exposure to data storytelling turn me (UP as Everyman) in to a punter?

What proportion of people move from playing Fantasy Premier League to laying bets?

Fantasy as gateway drug

Another quote from that night up the Orbit tower at Olympic Park in 2023.

Jump to: Knife to a Gunfight

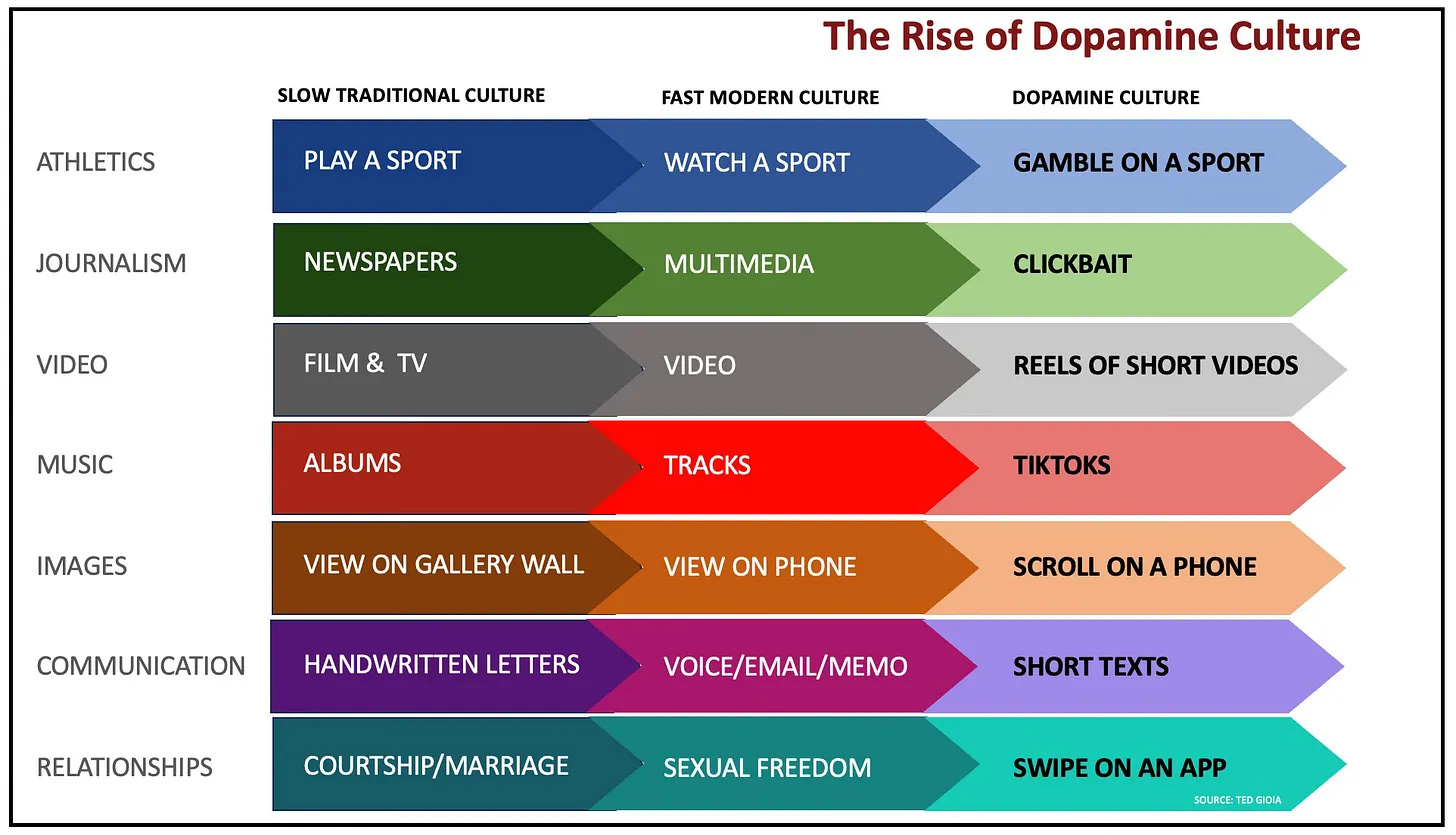

Sport is selling TV subscriptions in the era of the iPhone scroll.

The best essay you’ll read on where we are now is this one by Ted Giola:

It’s about the scroll, and dopamine addiction.

When applied to sport, you ultimately get to betting.

See also: Kornilov and Galstyan on convergence

Hear here: A Gambling Addict’s View of the Sports Business

Open or shut case

There was a palpable buzz around Expected Goals at the FT Business of Football event last week. Swiss Ramble is a fan. Enough said.

This week’s episode is great on the issue de jour: Representatives from all 23 clubs across the WSL and Women's Championship attended a quarterly meeting last Friday. Among the topics discussed was the suggestion to temporarily scrap relegation in the WSL, but still allow one club a season to earn promotion from the second tier.

A two-thirds majority vote, to be taken by all clubs in both tiers, will be needed in May for the change to be made. The proposals are still being refined but one, according to the Guardian, would lead to relegation being scrapped for four seasons, from the 2026-27 campaign, as part of a gradual plan to expand both the top flight and Championship to 16 teams.

Expected Goals co-host Maggie Murphy asks a really good question here:

The real question: Will clubs use these four safe years to innovate? Will they use the time buffer to attract external investment? Or will they coast? It’s likely down to the predilection of that club’s current leadership. I can’t see how the clubs who have shown disinterest in their women’s teams up until now will suddenly invest, just because relegation is off the table. So does this proposal not just reward stagnation? And without jeopardy, the bottom two-thirds of the WSL and WC could become a dull watch after a few weeks.

(Echoes here of a similar recent question: how will the influx of Hundred money be spent by the people in charge of county cricket?).

I’ve always wondered what it’s like being a fan of a crap team in a closed league. I assume the latter stages of an NFL season are tedious for this reason.

Anyhow, the open-closed chat prompted another dive in to the Unofficial archive.

The Unofficial Partner Billion Dollar Women’s Football Brainstorm

Another live podcast, this time at DAZN HQ in Hammersmith.

I set up the provocation: An IPL for Women’s Football.

Spoiler: There was not a lot of love in the room for this idea…

We threw the whole Sport by McKinsey playbook at it: no sports investment cliche was left un-referenced.

Best v Best; Global not local; Closed league; Franchise bidding: Room for investors to plan and build. etc etc blah blah blah.

An IPL type thing was my solution to the big, intractable problems of calendar chaos, club v country, player burnout and ‘the same or different’, my shorthand for the need for genuine differentiation between mens and women’s football.

My strongest card, I thought then and probably still do, was ‘do it before it’s done to you’.

I think this remains a big risk, that someone/something will write a massive cheque, pick off the talent and wreck the fragile eco system of women’s football.

I want the people running the game to care about the game, not some no name private equity empty suit.

There were 100 people in the room.

We put it to the vote.

Ten people put their hand up in favour.

I’ve often thought about that vote.

On reflection, I think timing played its part. We were just off the back of the European Super League weekend, and there was very little love for an idea that sounded similar.

And - breaking news - I’m a bloke. So standing up in front of a mainly female audience making a case for how the women’s game should be managed could’ve been construed as mansplaining.

Some people got properly cross, because they’re protective of their sport, the culture around it and the gains that have been made.

As I say on the podcast quite a bit, I’m instinctively against closed leagues, but think it might be a good idea in this case.

And that’s the first time for a while that I’ve found myself on the same side of an argument as Daniel Levy.

Have a listen here:

Double dipping, a user’s guide

Nearly half of the brand side decision makers questioned by Gemba think they’re getting bad advice.

That’s quite a thing isn’t it. Have a listen here:

Podcast titles, art or science?

This is a big question.

I’ve always done them myself.

But this week I put the above episode’s transcript in to the Unofficial Second Brain and asked the machine to give me “ten more click bait titles, based on the sources that address conflicts of interest in the sports marketing agency sector”.

This is what it came back with:

"The Sponsorship Game: When Advice and Sales Collide"

"Commissions vs. Credibility: Unmasking Conflicts of Interest in Sports Deals"

"Agency Double-Dealing: Are Brands Getting the Short End of the Stick?"

"Rights Holders Beware: How Conflicts of Interest Erode Long-Term Value"

"Procurement vs. Passion: Can Data Save Sponsorship from Itself?"

"The Churn Crisis: How Conflicts of Interest Fuel Sponsorship Instability"

"Beyond the Hype: Exposing the Dark Side of Sports Sponsorship".

"Siloed Strategies: Are Brands Sabotaging Their Own Sponsorship ROI?"

"From Cowboys to Consultants: Cleaning Up the Wild West of Sports Sponsorship"

"Zero-Based Budgeting: The Existential Threat to Commission-Driven Sponsorship"

Absolutely love From Cowboys to Consultants….

Now click on the button that is heart shaped

Even if you think you’re above such fripperies, and let’s face it, we’ll look back on this era of begging for engagement metrics as demeaning and slightly silly.

But even then, don’t be a bellend.

Press the button.