Dial 777 for basketball; Sports broadcaster or betting shop, spot the difference; Tom Gray on Spotify; Cryptotypes; Buzzer bulls v bears; All eyes on Eni Aluko; Paddy Power is a bully, pass it on;

The newsletter of the podcast

The investment case for British basketball

777 Partners are getting some profile in sport, mainly for buying in to football clubs - Vasco da Gama, Genoa, Seville. Their model is a ‘mini-Berkshire Hathaway’, which when translated means owning several insurance businesses that throw off cash that is then invested in to other projects, which they operate centrally from Miami, via other acquisitions in the group.

The argument for this model, nicked from Warren Buffett and Charlie Munger, is that the insurance-generated liquidity gives a longer runway than traditional p/e and offers some protection from volatility in interest rates when, as now, governments seek to defend against inflationary pressures by increasing rates and making borrowing more expensive.

777 bought the London Lions basketball team and, seeing that the value of their investment is linked directly to the commercial and marketing performance of the league as a whole, have bought that too: a 45% stake in BBL, which along with the London ownership gives them complete control.

So what now?

British basketball has long been a basket case but everyone can see the potential: The sport talks to black urban culture in a way nothing else does, including football. Sport England’s surveys routinely rank it second to soccer in terms of team sport participation.

Yet it’s invisible, crowded out by the NBA and the tedious confusion that is the club game in Europe.

777’s proof of concept is Australia, where Larry Kestelman sold the Dodo internet and phone business for $230million, bought the Melbourne Tigers and then the NBL. That was 2015 and the story since has been one of sport’s great turnarounds.

Buy low, sell high. Not a new plan, but one that makes a lot of sense.

In the British game’s case, much has to go right to emulate Kestelman’s success story.

There are other European markets where basketball has a stronger commercial footing, but maybe that’s the point: The British market is so weirdly underwhelming that any p/e injected improvement will reap greater benefits.

Hear Lenz Balan of 777 with Peter Hawkings, sports investment lead at Portas Consulting in this week’s podcast UP235.

See also: Is it cos I’m black? Former GB captain Kieron Achara: "The only logical explanation that I can give is that there is a subconscious bias against basketball and specifically the demographic that basketball represents."

Doesn’t take a Genius to see the what’s happening here…

Domestic basketball plays a role in this story too.

Sports data provider Genius Sports is paying Israeli AI production service Pixellot for exclusive distribution rights of its camera systems to more than 100 global leagues and federations across a wide array of sports.

Via Sportstechie: The two began collaborating in 2020, partnering to integrate live data and video for the Argentine Football Association, the Croatian Basketball Federation and Israeli Basketball Association, among others. This massive expansion of that program means Genius and Pixellot will produce livestreams for fans, coaches, sportsbooks and media partners.

Elsewhere, I hear that Sportradar, the other big betting data middleman, is offering to produce streams for free in return for distribution to their aggregated feeds, undercutting traditional production companies.

The more feeds, the more things to bet on via Genius or Sportradar’s own apps: 24/7, 365 days of the year.

It reduces sport to pure betting inventory, and in some markets the line between betting and broadcasting is blurring rapidly.

As mentioned previously, most analysis of private equity’s role in sport, hugely underplays the centrality of gambling in the business model.

See also: Sportradar and the rise of betting tech, UP186

Buzzer bulls v Buzzer bears…fight, fight, fight

OK, the headline might overplay this a bit.

As heavyweight prize fights go, 15 rounds between Yannick Ramcke and Charlie Boss would test even Barry Hearn’s legendary ticket selling nous.

But, Yannick and Charlie are divided on Buzzer, the media darling de jour.

Charlie likes it: a media solution created to meet the needs of today’s sports audience.

Yannick has doubts: I see the fit and need for a fit-for-purpose (that is reaching and monetizing) proposition catered to new consumption habits. But there is a difference between idea and execution: Buzzer is lacking key ingredients to serve that purpose, such as a built-in, highly segmented user base in which rights owners and broadcasters can tap into. Instead it needs to piggy-back on social platforms to spread the word. Why doesn’t tweet NBA itself, it’s a much bigger account..

Charlie: Isn’t that true of all start ups? They are betting on changing consumer habits, and that their proposition helps their partners (leagues or broadcasters) tap into them. Might not work, but what’s not to like in them trying?

Murray Barnett is Switzerland - neutral and focused entirely on the dosh: If it ever makes money, the leagues will copy it.

Murray: Is the aggregator helping the rightsholder or the other way around…Arguably the value of Buzzer is as a “reminder” to existing subscribers (or waverers) to use their subscription more hopefully preventing churn. Until someone cracks frictionless registration and micropayments, Buzzer will not make it big. I think they have their pricing wrong as well.

The Bundle is out tomorrow, available at all good pod stores.

‘A digital entrenchment of the old establishment’

Building on last week’s newsletter, 16 ways in to the Spotify Barcelona story.

This from Tom Gray on Friday’s pod resonated, particularly the line, ‘If music is a perfect sandpit for understanding digital markets….’

Hear Tom Gray in conversation with Matt Rogan and Joel Seymour Hyde from last week’s podcast UP234 Spotify Barcelona WTF?

Crypto stereotyping is a real time saver

Twenty percent of American adults, and 36 percent of millennials, own cryptocurrency, according to a recent Morning Consult survey.

This makes it hard to position crypto as a dodgy niche, which has become the default tone for coverage of sport’s relationship with the sector.

FIFA announced a deal with Crypto.com this week, which according to the FIFA website has more than 10 million customers and over 4,000 employees worldwide.

As this excellent explainer put it:

Crypto’s madcap, meme-crazed online culture can make it seem frivolous and shallow. It’s not. Cryptocurrencies, even the jokey ones, are part of a robust, well-funded ideological movement that has serious implications for our political and economic future.

It’s useful to see sport’s crypto sponsorship bonanza in the context of the broader marketing spend being undertaken by the sector.

We are already starting to see a swell of crypto money headed toward the U.S. political system. Crypto entrepreneurs are donating millions of dollars to candidates and causes, and lobbying firms have fanned out across the country to win support for pro-crypto legislation. In the coming years, crypto moguls will bankroll the campaigns of crypto-friendly candidates, or run for office themselves. Some will peddle influence in the familiar ways — forming super PACs, funding think tanks, etc. — while others will try to escape partisan gridlock altogether. (Crypto millionaires are already buying up land in the South Pacific to build their own blockchain utopias.)

Crypto is poised to soon become one of a handful of true wedge issues, with politicians all over the world forced to pick a side.

Deloitte’s football index is showing its age

Every consultancy: ‘We need a Deloitte-type thing; something that gives us regular PR’.

Deloitte’s Soccer Rich List has been hugely influential, both in terms of the framing of football finance but also as a piece of comms.

As with any league table, we look at the top and the bottom, and then search for our own team.

It generates acres of sports page coverage, positioning the consultant as the de facto football experts. The clubs love it or hate it, depending on where in the list they appear - note Milan’s sulk about their absence from this week’s list.

But..the market for football finance intel has moved on, and Deloitte’s reductive revenue-only basis of measurement feels out of step with the forensic brilliance of SwissRamble and Kieran Maguire of The Price of Football fame.

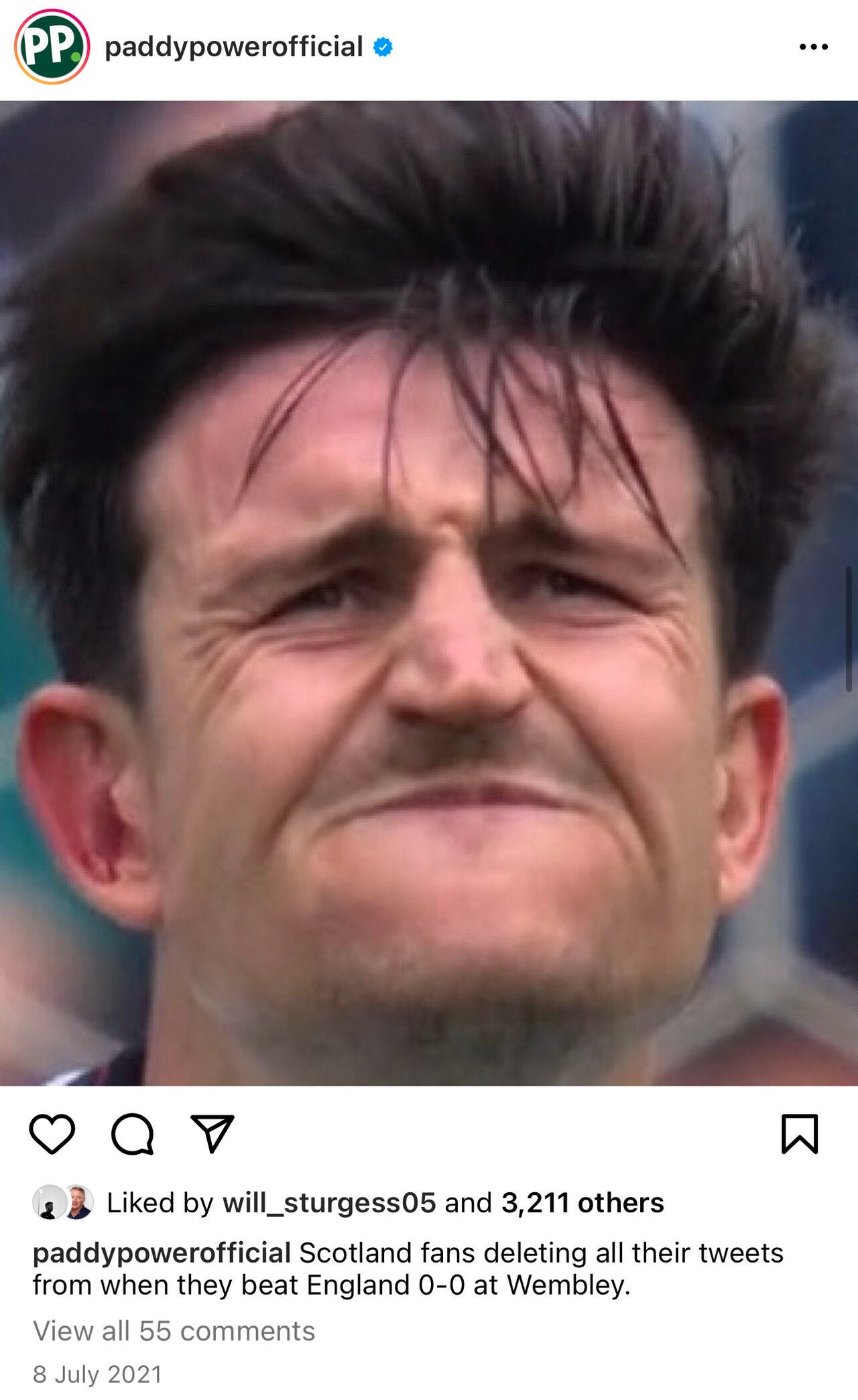

Paddy is misusing its Power

Great note from Richard Adelsberg, CEO of Ear to the Ground (UP143), on the weirdly nasty trolling of Harry Maguire by PP’s social team.

What is going on at Paddy Power? When did their risqué marketing turn into snide relentless bullying of individuals who are clearly are going through mental health struggles?

I wonder if anyone at the brand has reflected on the fact that in 2022 they’ve averaged one new instagram feed post a week taking the piss out of Harry Maguire?

It’s not only tone deaf, it’s just not funny. Their similar treatment of Phil Jones comes to mind too. At a time when suicide in young males is so common, I wonder whether the brand has put two and two together and realised that targetting individuals with constant playground bully chat is pretty fucking dangerous. By the way, this bully influences millions of sports fans every day.

It’s important that Angel City are also good on the field

The new NSWL season sets off, marking the first game of Angel City, the new franchise founded by a consortium including Natalie Portman, whose interview in The Guardian centred on the importance of the broader signal of female empowerment.

All eyes on Eni Aluko (UP209), the England, Chelsea and Juve star who is now Sporting Director of Angel City.

Her job is to make the team win on the field, not be the Harlem Globetrotters of women’s football.

The more the story of Angel City leads the agenda, the more pressure to perform on the field, and not just in terms of results: will they play a style of football that fits the brand? What sort of player is an Angel City player?

The risk, outlined by Aluko, is that people think they’re ‘a new shoe brand or a lifestyle product, not a football team’.

This gets to another question, what if the story is stronger than the sport?

I’ve always thought this about Formula E - what happens if the purpose is more interesting than the sport - and asked this question to Marcus John, an early stage investor in Formula E and ExtremeE - hear here UP Pod 127.

Soccer, America’s national game?

The media rights market suggests yes.

See also:

Chelsea’s debt and noisy bidders

Two good bits from Ed Warner’s newsletter.

First, some nicely acidic commentary on the bidders:

The noisiest bidders in any process - in this case, currently Martin Broughton’s consortium - are often creating waves to overcome a financial disadvantage.

And this, on the question of the debt.

My answer is that for every pound of debt in the club, its equity value falls by an amount less than one pound. The longer term the debt and the lower its rate of interest, the less the effect it has on Chelsea’s equity value.

In pre-war times, Abramovich looked unlikely ever to call in his loan which sits on Chelsea’s parent company accounts at a market rate of interest. Now though, a suddenly debt-free Chelsea would look a very different proposition to one with an obligation to HM Treasury that needed to be repaid over time. It’s little wonder then that owners of rival Premier League clubs are said to be crying foul at the prospect of Chelsea’s new owners being freed of the loan. If there is genuine competitive tension in Raine’s bid process, then the smart move for government would be to assume the debt owed to Abramovich itself and structure it to be repaid over a sufficiently long period at a reasonable rate of interest such that it does not materially undermine the value of Chelsea’s equity. It’s a delicate financial balancing act, but would satisfy demands for fair play while squeezing the pips of those - real fans or not - whose ambitions are engorged by the unexpected opportunity to grab the handles of this footballing trophy.

UP Yours

Jim Salveson has written a great post over on the Unofficial Partner guest blog.