Lesson from the NFL: don't bet on short term signals

The daily sports news agenda tells two apparently conflicting stories about the future commercial health of the sports sector.

The sports business model is broken.

Much of the sports industry conversation is focused on second guessing the implications of digital transformation on television audience behaviours, and by extension, future media rights values. The doomsday scenario pushes hard on the Napster analogy, which equates sport to the music business of the noughties, and sees sports rights holders sleepwalking to irrelevance.

The sports business is in a gold rush.

The professionalisation of sports leagues and teams has moved sports investment from a passion project to a legitimate asset class. Fuelled by near zero interest rates, billions of SPAC fronted dollars are sitting in the US financial system, desperate to buy in to teams, franchises and leagues because the sector remains a safe harbour in a fast changing media landscape.

You’ll have your own views and I’m not suggesting these two positions are mutually exclusive. It’s just the daily diet of news and views heightens our awareness of short term trends over long term fundamentals.

Beware ‘ratings slumps’

Covid has rendered any attempts at prediction almost meaningless by undermining the relevance of key data. In sport, the ratings are all over the place. (This from Kevin Draper in the New York Times):

Ratings for the N.B.A. finals were down 49 percent, and the N.H.L.’s Stanley Cup finals were down a whopping 61 percent. Baseball, golf, tennis, horse racing and other sports have all seen huge declines. Even the usually untouchable N.F.L. was down 13 percent through Week 5.

Draper makes the good point that it’s really hard to tell what’s causing this ‘ratings slump’.

Fewer people are watching television. More viewers than normal are choosing to watch news. Game schedules were optimized to safely complete events in a compressed time frame, not to maximize viewership. More sports than ever are happening at the same time and thus competing for eyeballs.

This builds on an earlier piece in the Huddle Up newsletter, by Joseph Pompliano, which questions the role of intangible factors such as the Black Lives Matters protests on recent NBA ratings.

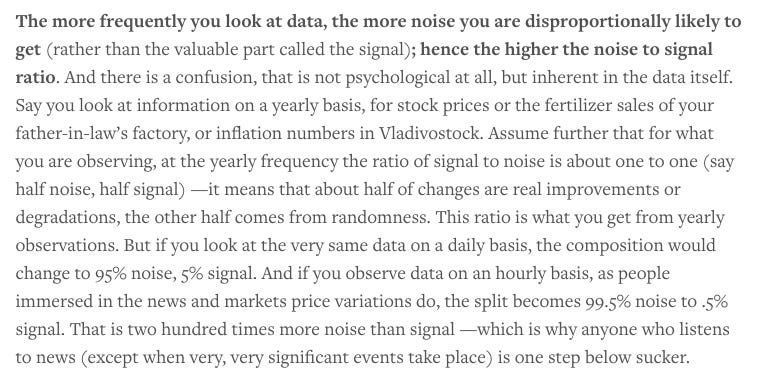

The message is clear. Media consultants who avidly follow isolated ratings are like investors who monitor hourly share price movements. This by Nassim Taleb is a warning on that.

By contrast, NFL domestic rights values are a long term indicator

Sometimes its tempting to use short term ratings news as evidence that ‘the sports market is broken’. Or, if you have skin the digital game, you might go in search of cord cutting stories and play them up a bit to bolster your position. If I was selling digital transformation I’d do the same.

Whatever, we’re approaching a key moment. The next round of NFL media rights deals come to the domestic market over the course of the next 12-18 months. North America is the biggest sports market in the world and the NFL is by some margin the biggest property in US sport. This goes beyond the States too, because the influence of the NFL extends well in to the boards of European football teams, whose cadre of American owners grew up worshipping at the altar of the NFL’s closed league model (see the European Breakaway League story below).

So what happens next is worth following.

The last time so many NFL rights came to market was in 2014.

Statista: Sports network ESPN agreed an eight-year deal with the NFL worth 15.2 billion U.S. dollars in 2011 – the contract extended the network’s deal to broadcast Monday Night Football from 2014 through to 2021. Fox added to its NFL portfolio by acquiring the broadcasting rights to the Thursday Night Football package in 2018 – the company paid around three billion U.S. dollars for a five-year deal running through to 2022.

As this SBJ chart shows, 2014 was the most significant year of the last decade in the US sports market, as several of the big rights holders locked down their media rights inventory.

I like this chart for a few reasons. It’s a reminder of how central television income is to the sports economy and shows the relatively long contracts between broadcaster and rights holder that are the norm in the US market. This was a point made by Claire Enders (Pod #107): that European Commission anti-monopoly legislation has led to short termism in the UK and European football market.

By contrast, Timo Lumme (Pod #112) of the IOC works to a planning horizon which is fundamentally different to his counterparts at say, the big five European leagues. As a result, the Olympic economy is based on a 12 year horizon, with the latest deals giving the IOC a measure of certainty until 2032. The most influential commercial partners - NBC and Coca-Cola - are among several to have renewed their deals to take in Paris 2024, LA 2028 and wherever 2032 ends up, plus the Winter Games and other IOC inventory along the way.

Just think what can change between now and 2032. Regime change; plague; Spurs winning the Prem: Literally, nothing’s off the table.

For example, this is what we were talking about in 2014, when the NFL rights last came to market:

Meanwhile, NFL Commissioner Roger Goodell is targeting $25 billion in revenue by 2027, or 6% annual growth (albeit that prediction was pre-Covid).

His optimism is based on some unsexy long term fundamentals: there’s still large numbers of Americans who want to watch sport on telly and are prepared to pay for it.

Chris Bevilacqua, founder of Bevilacqua Helfant Ventures (BHV): Everybody’s talking about cord-cutting and cord-shaving, but there are still 85 million people in this country paying to have paid television, and they’re paying their $120-$130 a month. That’s still a big business. Even it loses the 4%-5% per year over this next cycle of rights deals, you’re still at 60 million or 70 million people paying for the big bundle. And that doesn’t even account for the virtual [MVPDs], which are growing. (Source)

The other point, that’s often overlooked in the cord cutting argument is that how we choose to watch sport is an economic decision rather than shifts in inter-generational media behaviour. Put simply, it’s not about attention spans, its about money: Millennials and Gen Z can’t afford to pay for bundled subscriptions.

There’s some more cord cutting porn here.

Finally, will any of that SPAC money be going on a London franchise?

The NFL London franchise story is one of the hardy perennials of sports business reporting, up there with the European Breakaway League in terms of talk to action ratio.

The graphic below hints at the view from the American sports industry back in 2014, the start of the current rights cycle. It’s from Sports Business Journal, which commissioned a subscriber poll, via Turnkey Sports.

Six years on, the questions are still being asked and I wouldn’t expect the numbers to be much different. In the sports business, nothing’s real until someone writes a cheque.

Listen to this week’s podcast is with Neil Reynolds who fronts Sky’s NFL coverage and has built his own media brand around covering the game from this side of the pond.

Help us game the substack algorithm by sharing or liking this newsletter.