Me Me Me: sport tech is about psychology not gadgets

This week’s podcast is with Sam Seddon, who is IBM’s sports lead. Unsurprisingly, we talked a lot about technology, a subject that's really just a proxy for our relationship with the future.

I can’t get enough of this subject because it’s not about data or hardware but about psychology, and that means it’s about me. (Unofficial Rule: People who say, ‘it’s not about me’ are lying through their teeth).

Some of the best writing on the psychology of the future comes not from the tech sector but the financial world, such as Charlie Munger or Howard Marks - the investor not the drug mule who wrote Mr Nice. The first quote is Marks on the herd mentality, which is as clearly apparent in the sports business as any other sector:

‘The psychology of the investing herd moves in a regular, pendulum-like pattern—from optimism to pessimism; from credulousness to skepticism; from fear of missing opportunity to fear of losing money; and thus from eagerness to buy to urgency to sell. The swing of the pendulum causes the herd to buy at high prices and sell at low prices. Thus, being part of the herd is a formula for disaster, whereas contrarianism at the extremes will help to avert losses and lead eventually to success.’

And this one, where Marks talks of the need to think in bets, aka probabilities.

"Successful gamblers—and successful forecasters of any kind—do not think of the future in terms of no-lose bets, unimpeachable theories, and infinitely precise measurements. These are the illusions of the sucker, the sirens of his overconfidence. Successful gamblers, instead, think of the future as speckles of probability, flickering upward and downward like a stock market ticker to every new jolt of information. When their estimates of these probabilities diverge by a sufficient margin from the odds on offer, they may place a bet”.

One of the themes of Marks’ work is to the simple sounding mantra of realistic expectations. Again, you only need spend a few minutes at a sports tech conference to get that South Sea bubble feeling. And as Marks notes:

‘The most dangerous investment conditions generally stem from psychology that’s too positive.’

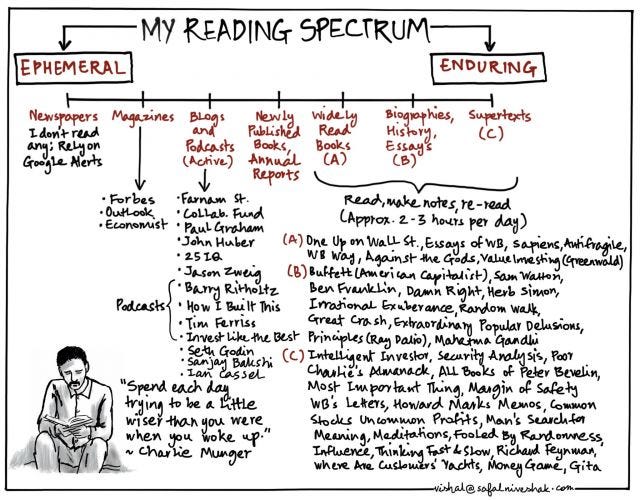

While we’re on what we can learn from finance literature, below is a nice summary of how another good writer - Vishal Khandelwal - goes about the job of organising his reading material. I don’t necessarily agree with his choices but I like the short to long categorisation.

The Sam Seddon podcast is here, have a listen, it’s really good.