Napster for sport; Truthiness and end of the world stories; The meaning of Sportradar; Selling the Premier League v Selling Burnley-Norwich; Every picture tells a story; Cliche corner

The newsletter of the podcast

Join the thousands of people who subscribe to Unofficial Partner.

We publish two podcasts each week, on Tuesday and Friday.

These are deep conversations with smart people from inside and outside sport.

This newsletter is our way of picking up the threads, and is published every Thursday.

Our entire back catalogue of over 200 sports business conversations are available free of charge here.

Each pod is available on Apple, Spotify, Google, Stitcher and every podcast app.

If you’re interested in collaborating with Unofficial Partner to create one-off podcasts or series, you can reach us by replying to this email.

The Napster analogy and the end of the world story

If a guest has a background in music, and Simon Bazalgette certainly does, I like to ask The Napster Question.

Bazalgette founded Music Choice Europe, an early iteration of digital radio and today’s streaming services. It was co-owned by the labels, such as EMI, Time Warner and Sony, and IPO’d in 2000 with 14million subscribers.

Despite this structure, people running the big labels wanted to kill it off, because they feared digital was the death of the music industry, which it sort of was, but not because of Music Choice which they owned, but because of Napster, which they didn’t.

The Napster Question is a way in to a conversation about important lessons for the sports biz, or ‘Learnings’ if you’re reading this on LinkedIn.

Is the experience of the music industry a predictor of sport’s digital future? Or not. Note, we’re using Napster as the proxy for the collapse of an industry due to it’s slow or wrong response to tech change.

Bazalgette: ‘I could see the music industry was writing it’s own death warrant’.

The record business today is really just the middle man between the artists and Spotify: “Spotify is the music business. Most of the revenues music labels make come from Spotify, it’s Spotify who knows what people like, it’s got the data and the relationships. The artists don’t have it, the labels don’t have it. The record companies aren’t really selling anything anymore, they were never direct to consumer, instead pushing product via wholesalers”.

There are certainly elements of the story that apply to sport: The creator-wholesaler-retailer-customer chain is clearly recognisable. Whereas albums were sold via record shops, sports rights are sold via their own retailers, aka broadcasters.

So why hasn’t sport collapsed in the same way as music did in the noughts?

There seem to be two broad answers - a) specificity and b) it’s too soon to tell, aka, ‘Just wait, it hasn’t happened yet’.

a) There are some specific differences between sport and music that undermine the Napster comparison and so protect sport from a complete collapse in value. (See previous newsletter on WhatWentRight)

b) Too Soon To Tell (TSTT) is impossible to argue against. Because it’s TSTT.

If I’m selling a micro solution to the future, a tool, or a strategy or some sports specific SaaS, I’d push TSTT too. It’s a good story.

Good stories don’t need to be true, they just have to feel true. The Napster analogy has, to quote Stephen Colbert, ‘truthiness’. You can feel it pulling you in a direction, lending a theory a sense of inevitability.

‘Sport’s Napster Moment’ is an end-of-the-world story - see also ‘Five minutes to midnight’ recently employed by Boris Johnson at COP26.

The end of the world is a frightening idea, employed to incentivise an immediate response: Act now or lose everything.

In sport’s case, the reality of this is, ‘go D2C or you’re media rights values will go down, particularly if you’re in the mid-market’, which lacks a bit of punch, particularly when couched under the bureaucratic umbrella heading of ‘digital transformation’.

But…

What if, the end of the world has happened, but we just haven’t realised yet

I keep thinking about the Sportradar IPO.

$8billion.

Today, Sportradar has become a dominant player in the sports data space. After expanding into the U.S. in 2014, it boasts more than 900 sports betting clients, such as DraftKings, FanDuel and Flutter, and 150-plus sports league partners, including the NBA, MLB and the NHL….According to its pre-IPO filings, Sportradar posted nearly $18 million in net profit off $478 million in revenue last year.

A counter factual history of the past ten years would see Sport Inc - every major sports rights holder working in collaboration - ringing that Nasdaq bell instead of Michael Jordan and the bloke from Sportradar who went home to Switzerland with over 2billion quid.

The money they’ve just trousered would instead flow through the sports economy, sustaining the grass roots which instead are left to beg for charity from governments and the 1%.

This didn’t happen because…zero sum, short termism, narrow expertise, lack of vision, the game’s on Saturday etc etc.

The reality is – as a consequence of never really understanding, much less prioritising marketing – is that for the past 15 years we have outsourced our engagement strategy to Facebook and the like. We have done this for a number of reasons: it was cheap, quick and easy; it enabled us to counter fragmenting media numbers with new, equally high “engagement” stats for sponsorship sales purposes; and everybody else was doing it, so it must have been the right thing to do.

The net result is that those platforms made a lot of other people very wealthy and none of the revenues, nor the customer data were shared, meaning that as the momentum behind D2C has gathered pace, sport has missed out on 10-15 years of genuinely immersing itself in building the customer experience, learning what people want (and don’t want) and through that process, building repeat business and advocacy in the way that those digital platforms largely have done.

Just as Facebook joined the dots on fan engagement, so Sportradar (and Genius Sports) has done in betting.

Another gold rush is here and the sports biz wakes up to find that someone else has sold their shovels.

It’s not the end of the world, just business as usual.

Bundle/Unbundle: Premier League in the US

The Bundle dissected the Premier League’s US rights auction, with Yannick the Wunderkind, Hannah Brown and Murray Barnett.

The obvious endpoint is that who offers the most money will get the rights.

But there are some noteworthy features to this round, which talk to the nature of premium-ness, and whether it travels.

Beyond ‘how do we make the most money’, a question for the PL rights team this time was whether the US market is ready to split the property across multiple broadcasters.

The second level considerations are about confidence and storytelling.

NBC has been the league's home for the last three or four cycles.

This consistency of platform has landed the story of the league in the imagination of American viewers by making it easy to follow.

So, now to confidence.

Is the Prem’s US story strong enough to survive the friction, irritation and cost that comes with following the progress of the league across two or three outlets, and across network and streaming channels?

More is sometimes more: The NBA and NFL in the US have the marketing oomph of multiple broadcasters.

But the drawback to splitting is more acute for non-indigenous properties, as time differences become more significant and the variability of the product becomes exposed.

As Hannah Brown said: ‘There are only so many good games’.

Or put another way, there’s a point when ‘The Premier League’ becomes ‘Burnley v Norwich’.

So the package picking process is paramount (try saying that after fourteen WKDs) and how this bit of the negotiation impacts on game times and scheduling back in the UK.

Summary: The money is sure to rise. It will be interesting to note what’s been sold along the way.

See also: Enders Analysis of Sky’s financials show the money saved by centralising sports rights acquisition across Europe, and the shift from satellite to IP-only delivery, with much riding on the launch of Sky Glass, their first in-house telly. Buffering and latency are concerns, particularly when it comes to sport.

Sky has been right to proceed cautiously given viewers’ intolerances for delays or buffering when streaming goes awry. This becomes particularly apparent during large, simultaneous events such as live sport, still a key tentpole for Sky—just consider Amazon’s issues when it first aired US Open tennis in 2018, DAZN’s ongoing difficulties in Italy with the Serie A, or the reportedly 10-minute lags for some users of ITV Hub’s stream during the most recent Euros.

Every picture tells a story pt1

The 2018 Yorkshire CCC team photo. (HT to Tim Crow for sharing on WhatsUP).

Every picture tells a story pt2

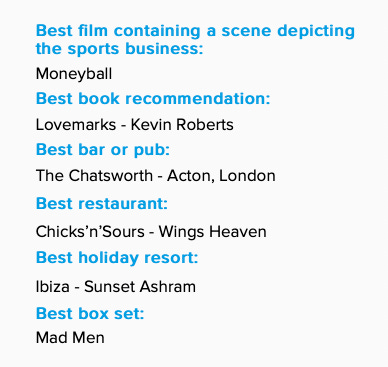

Personal Best

Sports biz types list their favourite things

This week: Flo Williams, founder of The Perception Agency

Cliche Corner

Millennial attention spans, Man Utd’s fan base, I care what my soup believes in: Eddie May is compiling a list.

Enjoy the Unofficial Partner newsletter? Tell your friends

Subscribe to the Unofficial Partner podcast.

Help us game the Substack algorithm by liking this newsletter and spread the word on social media.

Follow @RichardGillis1 and @PaulPingles (aka the ill-judged Twitter handle of Sean Singleton, the UP co-founder).

Read over 100 gushing five star reviews for UP on Apple Podcasts - click the link to add yours.