OTT's boring endgame; Daly Jr's Hooter NIL; Don't Bend Over For Beckham; Fulham's Guide to Parachute Payments; The end of the pandemic boom; What sponsors think of funding FIFA+; ARPU to you too, etc

The newsletter of the podcast

A brand new channel for your sponsors.

This week's UP newsletter is sponsored by our friends at Voiceworks.

Podcast advertising is one of the most effective forms of marketing communication, offering better recall and impact than video. The Global podcast advertising market is worth over $8bn – set to rise to $38bn by 2026 (IMARC).

Voiceworks Sport can develop an audio strategy that works for you and your partners creating great engaging content and brand new revenue streams.

Guess who’s expected to cough for sport’s great D2C revolution?

Let’s play join the dots, where we take a news story and bring it back to the sports business, minus the specificity that might render the whole thing moot.

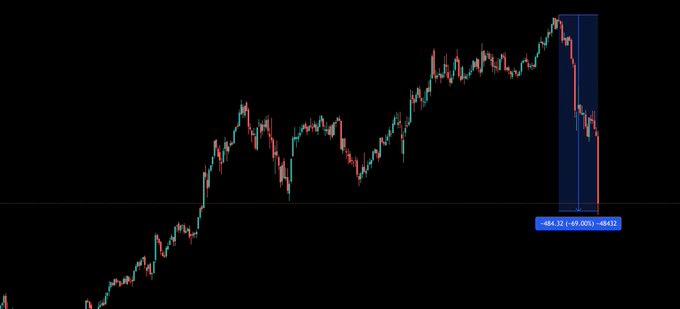

This graph has put in the hard yards this week.

Netflix share price is down 69% on its all time high (April 2020).

Takes aplenty: The End of the Pandemic Boom, cost of living crisis, inflation, greater streaming competition, a perceived decline in Netflix’s content quality, password sharing (dead cat) and Vladimir Putin are all in the frame.

So is anyone calling themselves the Netflix for Sport this week?

Netflix remains the market leader in terms of the big streamers, and if people are bailing on them, the rest have reason to worry.

This from Enders Analysis, is an excellent - well, how do we put it - analysis:

While losing subscribers in Q1, Netflix still increased revenue (from $7.7 to $7.9 billion) which articulates the purpose behind its attempts to change the company’s story from one centred on subscriber numbers to one based on other metrics such as revenue, ARPU2 or engagement, in all of which Netflix outstrips the competition: while the potential size of the streaming market is contentious there is no doubt who leads it. We have tracked this narrative shift in the past and largely agree with it—bundling and free/cut price subscriptions mean that subscriber numbers can be inflated with little revenue upside. Conversely, Netflix has shown that essentially it has the ability to do the opposite: through price rises it can lift revenue even when there is a fall in the number of subscribers. We are doubtful that its competitors have the power to do this yet.

Netflix is important because it sets the price point for every other streamer, sport or not. Nobody can charge more than Netflix.

This is why DAZN has problems: it can’t afford the supply-side cost (Premier League rights in the UK for example) and maintain the Netflix price point at the retail end.

And for DAZN, read every sport specific OTT platform launched in the last five years.

Enter the platform economics argument: basically, what else can you flog to make money from a streaming service if the subscribers aren’t footing the bill?

This pushes sport further in to the arms of the betting firms. Other things too, but mainly betting (NFL Seeks Sports Betting Czar).

But…what if, you launch a big, expensive D2C sport service but prefer the rarefied air of the moral high ground? For example, FIFA+ or The Olympic Channel, both of which can’t/won’t take betting money.

See Frank Dunne’s very good piece in SportBusiness: “Fifa seeks massive increase from sponsors on the back of Fifa+ launch”.

By delivering a steady flow of lower league Puerta Rican football, FIFA will now argue that they are delivering extra value to existing partners by spreading their presence in our lives beyond the quadrennial World Cups.

“We will be the premier destination for football content. Period.” So said Kay Madati, through a car window as he sped out of FIFA’s commercial office multi storey after less than a year in the job.

It’s a nice try.

But in real life, the sponsors may baulk at being on the hook for Gianni Infantino’s grand D2C project.

Ricardo Fort, via WhatsUP: The idea that FIFA+ will justify increased fees makes zero sense now and will make zero sense in 10 years. I have discussed FIFA+ with them for years. It is a must have for a rightsholder of this size and can really benefit partners. But sponsors will not pay more for accessing the likes of the second division of the Thai league. Volume doesn't justify investments. FIFA will eventually add a FIFA+ "mandatory" ad inventory to regular sponsorship contracts forcing sponsors to use it. FIFA+ is one of those things they had to do and I hope it succeeds. The mistake is believing it can be a sustainable business on its own. That will never happen.

We’re at an interesting moment.

Because within the purist D2C argument is a disdain for the sponsor-funded model.

From The Athletic to Netflix, an air of defeat accompanies the shift to paid media and all the crappy adtech-driven abuses of personal data that come with it.

There’s a sense that a promise has been broken, because subscribers (and fans) end up paying twice: once with money and then again, with their attention.

Listen to Reed Hastings this week.

“Those that have followed Netflix know that I’ve been against the complexity of advertising and a big fan of the simplicity of subscription. But as much as I’m a fan of that, I’m a bigger fan of consumer choice. And allowing consumers who would like to have a lower price and are advertising-tolerant get what they want, makes a lot of sense.”

Key metric: The price elasticity of sport

The current downturn will test an old adage. The demand for live sport has always been assumed to be inelastic, ie demand stays stable as prices rise.

That’s probably still true of some sports in some markets; we all know who they are.

But the arguments for sport’s D2C experiment have never been tested by market conditions as they exist today.

Useful nuance: Kantar say churn rates for SVOD services are currently increasing but that Netflix and Prime Video are categorised separately from the other services, as the last to go when households were budgeting for rising costs. By contrast Disney+, the darling of early-Covid, tripled its quarterly churn to 12% this quarter.

Sport’s C-suite clings to the received wisdom that exclusive live sport is protected from the churn volatility currently being endured by generalist streamers.

From FIFA and the IOC down, there’s a lot riding on that notion.

Campaign idea of the Week: Don’t Bend Over For Beckham

The plans for Inter Miami’s new stadium aren’t going down well locally.

Context: There’s a storied history to tax payers funding the stadiums of billionaire team owners.

In 2016, the Brookings Institute published a paper against using public dollars to fund stadiums. The report estimated from 2000 to 2014, more than $3 billion in tax revenue was lost on tax-exempt municipal bonds used to finance pro sports venues.

Fulham’s Guide to Parachute Payments

As EFL Chair Rick Parry said on UP183:

"If government wanted to do us a favour, they could just say parachute payments: illegal. Now go and sort out redistribution... 'Owning a Championship club is 'the most expensive lottery ticket on the planet...' 'The model is nuts'.

The graph below supports his view. (Via @KieranMaguire)

Hear also: Good Owner, Bad Owner UP238

A series of small disruptions

An unknown player wants to modernise snooker to reach Gen Z.

NIL by mouth: John Daly’s college golfing son has signed a deal with Hooters. It’s just what the Supreme Court imagined.

3. The Match series started as a pay-per-view event face-off between Tiger Woods v Phil Mickelson. Then they added celebs. The next iteration has dumped the golfers completely, in favour of four quarterbacks.

“What we are thinking of is a pop culture event that makes golf much more fast paced and is looking to younger viewers,” Will Funk, executive vice president of sports partnerships and branded content at Turner Sports, told Variety in a 2020 interview. “This is a world-class golf competition meets ‘Dancing With the Stars.’”

He was half right.

Job of the week

Senior Vice-President, Consultancy & Sponsorship - MKTG Sport + Entertainment

The Blurb: MKTG Sport + Entertainment is looking for an established sponsorship and partnerships professional to help develop and grow our senior level consultancy offering for clients across the region.

You will be responsible for, setting the vision for, and running, our largest division with a focus on offering industry-leading advice and consultancy to clients. Supported by a highly capable team the consultancy and sponsorship division take on anything from partnership strategy, negotiation and consultancy through to activation and implementation of client sponsorships.

The Link https://www.linkedin.com/jobs/view/1575141957