Ranking points and fake narratives; Slams Assemble; The PGL's JV; Are you crypto-curious; IOC C-Sweet; Chasing ghosts; Adtech is rubbish; TEAM's UCCSA target

Overthinking the sports business, for money

Fake narrative: The peculiar rise of ranking points

Context: ATP and WTA are withholding ranking points from Wimbledon.

Naomi Osaka said Wimbledon without points is akin to ‘an exhibition’.

Not for the first time, Andy Murray is on the right side of the argument.

Fwiw, world rankings are high on my list of things about which I don’t give a toss.

The coronation of the new ‘world number one’ is at the WWE end of the ‘is it real?' spectrum.

Rankings are a marketing conceit, an attempt to impose a year long narrative on sports such as tennis and golf, where the real story is built around four tent pole major events.

But this devalues the rest of the event inventory being flogged by the ATP, WTA, PGA Tour, European Tour etc etc. (That’s before you get to cricket, rugby and football).

The last week has revealed an under reported schism between players and fans.

Players view world rankings as the gold standard currency, the framework by which sponsors reward performance.

For most fans - 90%? - the rankings list delivers the drama of a health and safety manual.

Worse, they reward consistency over excellence, distort the event schedule and mask the role of appearance money in shaping playing choices.

As a fan I prefer incentives to be obvious rather than opaque: I like to know who’s trying when.

(Particularly if I’ve got a bet on, which is rare but I’ve heard its popular)

So, I’m prejudiced against ranking points and toward history, in the form of the Slams or the Majors.

Second bounce - The Slams v The Players

Cue: Another billion dollar business idea.

The more Naomi, Djoko et al go on about ranking points and Russia, the more another future for tennis can be glimpsed.

The ATP and WTA have an ownership structure akin to the golf tours - in essence, they exist to serve their members, the players.

By extension, this means they don’t get up in the morning and think of how best to serve the punters.

That makes them vulnerable.

If you had a big pot of OPM (Other People’s Money), how would you spend it in tennis?

You could create yet another crap, meaningless event, or do a PGL/LIV thing with teams and Centurions and centrally sold baseball caps.

Or, you could unite the Grand Slams under a single brand (see Rob Mills’ prescient piece from 2017), as a counterpoint to the self indulgence of the player groups.

The four big events are the most salient brands in tennis and would be the basis of an exciting new concept - a tennis tour that mattered.

Lay in a couple of other tournaments - a clay court run-in to Paris, grass to SW19 and…whatever it is they play on at the US and Australian - and quite quickly you’d have something interesting, based around the championships most people care about.

No world rankings are needed because - and this is not a new idea btw - the men and women who win the Slams are the best players in the world.

Over indexing on disruption, my week in golf

Last week I spoke at length with Sean Bratches of LIV Golf. (Sean resigned a few days later: the curse of Unofficial Partner).

This week, I spoke at length with Andy Gardiner of Premier Golf League.

Mentioned on Twitter, I’m surprised how much I like the idea of the Premier Golf League.

I’m not sure whether my interest in PGL is due to the product on offer, or my disillusionment with the status quo. For someone who really likes golf, I shouldn’t find watching it so tiresome.

It’s not like I don’t have reservations, and modelling the value of PGL teams of four golfers against an IPL franchise is a heck of a stretch.

Whatever.

Here’s a few things I noticed.

The JV element proposed by the PGL could be the ‘third way’ between the Tours and LIV Golf’s model, that requires a massive upfront bribe to a few of the best players.

Andy Gardiner is promising $10bn of equity value in the PGL by 2031. Allen & Co via Rory McIlroy said this isn’t possible, equating it to ‘20 Ryder Cups a year’.

Gardiner countered on the pod, and his answer revealed the extent by which his model is based on hosting fees.

I can tell you what the French paid for the Ryder cup in Paris, because I've got the contracts. I've seen the figure. If you had 20 of those, you're not talking about a $10 billion business. You're talking about a $100 billion business. Now that is not a model that is deployed by the PGA of America…it's different, but that takes you back to Formula One.

When you go through the annual statement of Formula One Group, and you see how much is paid just for the privilege of hosting an event, because that is a big circus, you know, in terms of you marketing your territory, your country, your city, your state, it's highly attractive.

It doesn't exist in the US to such a degree because there's a lot of golf being played there. But when you get outside of the US you're talking about six events, that will be very highly sought after, by multiple nations. And that's another part of the model. I wouldn't expect those in the US to understand, because it's not a model that they're familiar with.

4. Who will be Notts County?

This is the answer of a niche sports business quiz question: Of the teams who voted in favour of the formation of the Premier League, one club has never played in it.

If Gardiner gets his way, the PGL will be subject to a vote by this year’s cohort of player members of the PGA Policy Board. This brings in a much wider constituency of players who stand to benefit, beyond the handful of stars.

Andy Gardiner: …they are 12, 15 guys out of 250 voting members. If this has to happen in a collaborative way, what you require is 51% of that membership to say they want it to happen. So 12 guys can't make it happen, but 135 can.

Now who are those 135 guys? If this comes to pass that they decided that this is something that they want to do there’s a very strong likelihood every single one of those voting members ends up with $20 million worth of equity by 2032. That is literally just for being a voting member right now.

Words and phrases: Crypto-curious

A little insight in to how a big gaming firm is evolving its web3 thinking, which compares to the - how do we put it? - more sales-focused approach from the sports sector.

Life’s sweet in the IOC C suite

Good piece by David Owen on the new IOC accounts.

The income from the last period appears to have risen by 31%. But the distribution of the cash is uneven.

One group to have benefited is the IOC’s executive management.

Their aggregate salaries and short-term benefits reached $13.95 million (£11.2 million/€13.2 million) in 2021, up from $11.65 million (£9.3 million/€11 million) a year earlier and just $8.5 million (£6.8 million/€8 million) in 2017.

This amounts to an advance of more than 64 per cent between 2017 and 2021, although the number of individuals covered may not have remained constant.

After crunching the numbers, another body which I have firmly on my list of "winners" is the dear old United States Olympic and Paralympic Committee (USOPC).

Chasing ghosts

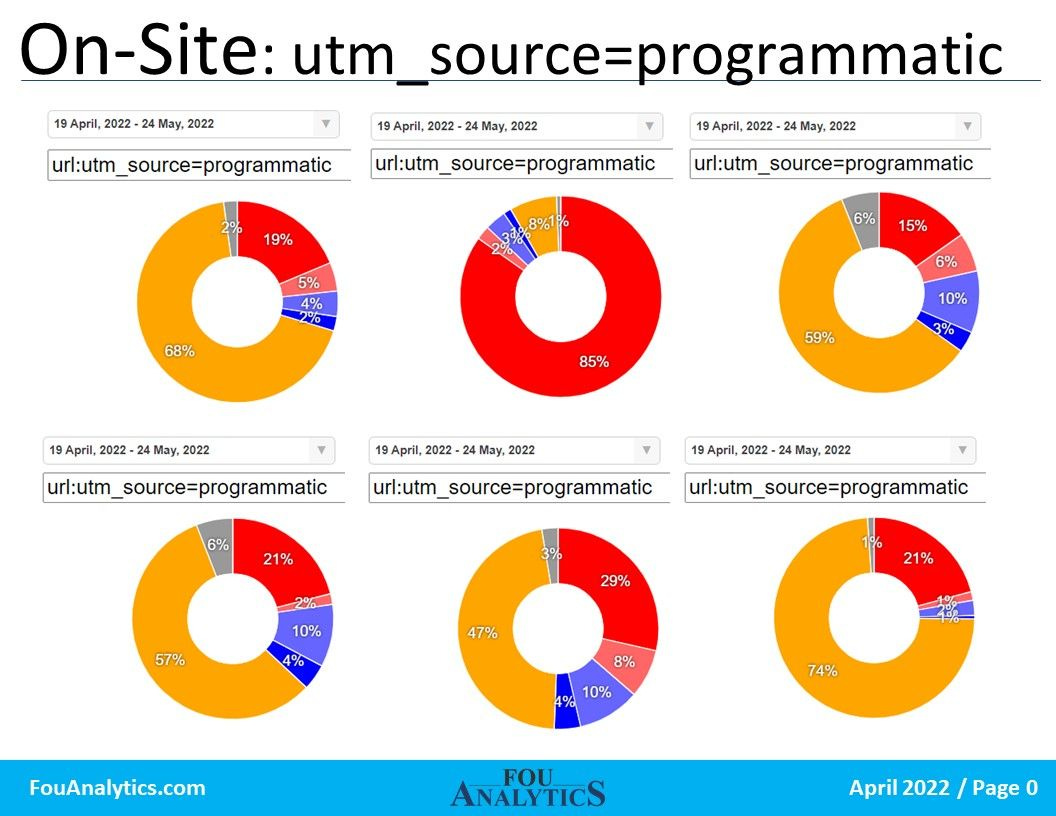

Dr Augustine Fou audited clicks arriving from programmatic ad campaigns on six different sites.

Orange and red are bots. Dark blue are human beings, clicking on ads…

So what?

Fou - a two time UP guest - is making an important argument about what has gone wrong with digital marketing and how the rise of adtech has undermined the potential of the internet as a marketing channel.

He’s changed my view on topics including the Long Tail, behavioural and hyper targeting and the reality of programmatic media buying.

A generation of marketers have been conned in to expecting massive audiences for their content, says Fou, but the reality is very different, bringing in to question the real returns sponsors get from branded content, mobile video and performance marketing.

Hear here: UP129 How adtech ruined the internet

Can TEAM hit UCCSA’s forecast?

Martin Ross on the context to UEFA’s newly launched 2024-27 broadcast rights sales process.

Team generated around €3.6bn ($3.9bn) per season from commercial rights to Uefa’s club competitions during the 2021-24 cycle.

This figure is forecast to rise by 39 per cent according to projections laid out by the joint venture formed by Uefa and the European Club Association (ECA). Relevent’s deal for media rights in the US is based on a guaranteed amount of $250m (€234.5m) per season, while Team’s mandate for commercial rights in all other markets is based on projected income alone with no guarantee provided. Uefa Club Competitions SA (UCCSA), a joint venture between Uefa and the ECA, was created to oversee the global tender process.

See previous UP Newsletter on the issues surrounding TEAM Marketing’s role and the decision to put that out to tender.

TEAM won the tender and are now back doing what they’ve always done. Make shedloads of money for UEFA.

The Job: Two Circles - Sponsorship Strategy & Insights Lead

The Blurb: The Sport Industry Agency of the Year is looking for a Commercial Strategy & Insights Lead to work in its fast-growing Rights Management team, leading the insights that underpin sponsorship sales processes for the world’s leading sports properties.

The role, based in London, has a range of duties which include undertaking primary and secondary research into sports properties, articulating the wider macro trends within the sports sponsorship economy, identifying new trends, understanding the challenges rights-holders face today, and finding development areas. It is suitable for someone with experience in strategy, consultancy, agency environments or across a leading rights-holder, and an ability to articulate ideas and strategies to grow and change commercial revenues.

The Link: To register your interest or apply, please email recruitment@twocircles.com with your CV and cover note, referencing this advertisement in the Unofficial Partner newsletter.

So what did you do to cause Bratches to quit? 😉

More what Greg said presumably...