The $100million Challenge; ESG WTF; Amazon's Black Friday Super Bowl; AI v Infantino; TGL v Selling Shovels; Poulter's bag; Crap idea of the week; The Scudamore caveat

Overthinking the sports business, for money

See you next Tuesday…

Final tickets for the UP Christmas Do are here.

Word has it there are vol-au-vants.

Thanks as ever to our partners Sponsorworks for all their help.

Press the button to get Christmas started.

The 100 Million Dollar Challenge

Film pitch: Brewster’s Millions 2. More money, fewer laughs.

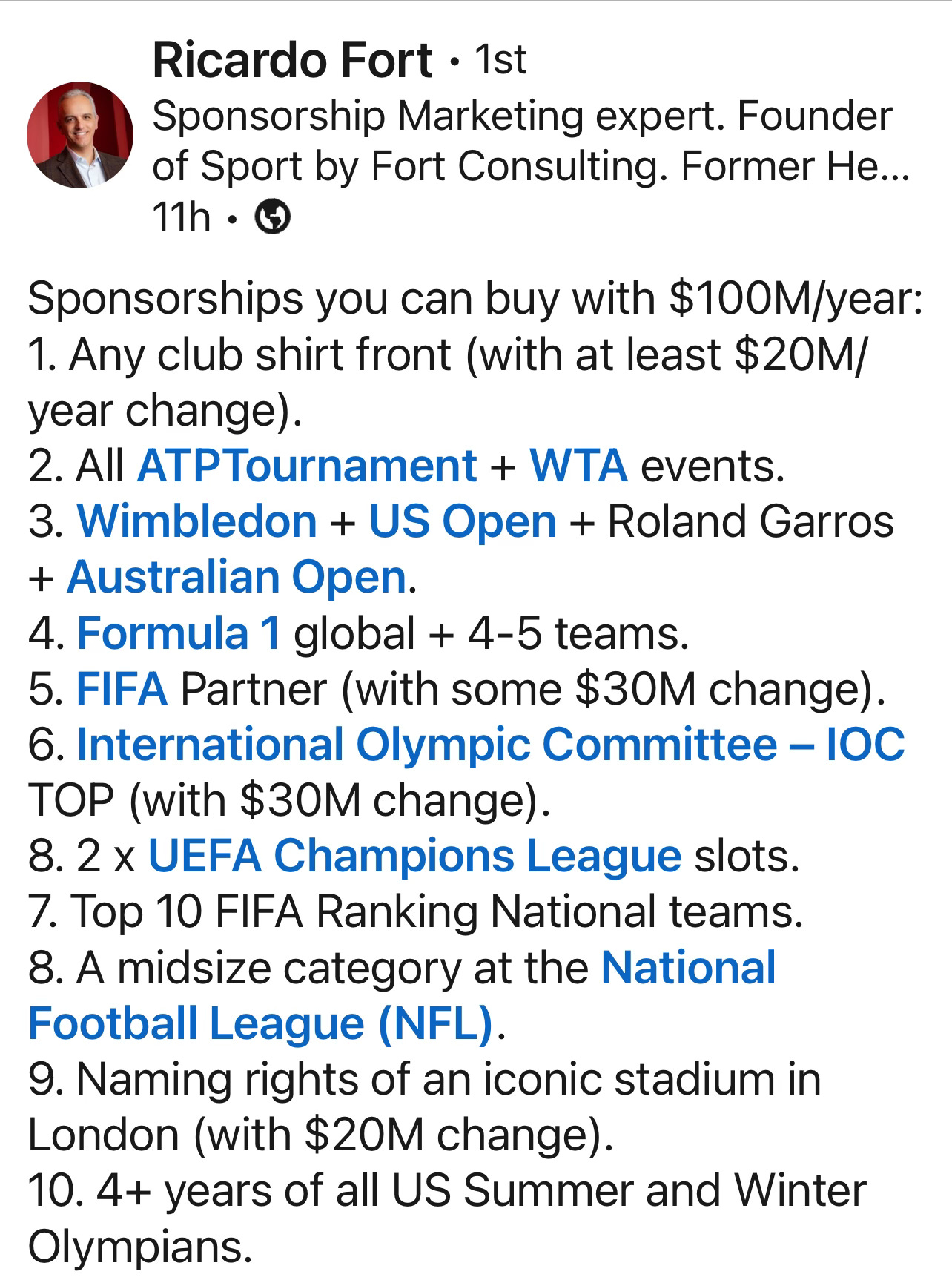

The former Coke global sport supremo is given a hundred mill to spend in 24 hours.

Extending Ricardo’s question, how else do you spend 100million in sport?

For Amazon, it went on tomorrow’s game between the Dolphins and the Jets.

Amazon’s Black Thursday Thanksgiving Super Bowl Moment

It’s a big week for Amazon.

And many in sport will watch and learn.

It’s a week where the ROI model on media rights is shifting in real time.

Today is Thanksgiving, tomorrow is Black Friday.

Amazon paid $100m for exclusive NFL rights to tomorrow’s first ever Black Friday game.

They are putting it out for free on Prime, outside their TNF subs deal.

So, big audience.

And a new bit of sports real estate.

To add to Amazon’s massive Thursday Night Football outlay.

Ad spot prices for tomorrow have doubled from $440,000 to $880,000 (see UP Rule: the numbers are always wrong).

The ad inventory is very fashion forward - they are shoppable, so punters can click to buy from off the telly.

And brands can target different segments with different products, using Amazon’s audience based creative service.

This opens up football to consumer product sectors pushing pre-Christmas offers.

Among the advertisers that have lined up to support the game are Google and Carnival Cruises, both of which will serve as presenting sponsors. Meanwhile, Hasbro, Bose and Columbia Sportswear will also advertise, according to Carney. The executive says viewers are likely to see commercials from marketers who might not normally sign up for an NFL game, and will see more consumer-products companies than might typically show up in a football event. Still, she adds, “we will have a nice mix of insurance, financial, auto and the traditional guys.”

This sort of innovation quickly becomes the expected product.

‘What do you mean, you can’t deliver precisely targeted shoppable ads? What is this, 2008?’

Build - Look out for our podcast with Amazon’s Tia White next Friday, part of our Two Circles Project 2030 Series.

Proof of concept or outlier?

Is this a model that’s replicable?

Or is it just Amazon’s scale and tech moat that allows them to make sports rights work this way?

It’s a question heading over here soon.

As the domestic rights to the Premier League come to market, what’s in the new package that could do the same job?

Is the Premier League willing/capable of generating new high value IP for Amazon and others in the same way?

Creativity in a downturn

A few years ago, such innovation would be filed under ‘nice to have’.

The money flowed in based on the old subs and ads ROI model.

But across Europe, the energy in the football media rights market has gone down a notch.

The French and Italian leagues have played a bad hand over a long period of time, undermining the value of their own rights by doing daft deals with flaky outlets, going for short term wins over longer term brand building.

In trying to flog Ligue1, the LFP has taken the audacious route of publishing minimum reserve prices.

The governing body has set reserve prices of €530 million (US$561 million) and €270 million (US$286 million) for the league’s two main live packages, equating to annual increases of €10 million (US$10.6 million) and €5 million (US$5.3 million) respectively.

This is cheeky in a market where the big dog - Canal+ - has had enough, and ruled out a bid.

And Viaplay has exited.

So it’s tough out there, and the pressure to get a big number is enormous, as mismanaged clubs demand the next bailout.

Note the EFL’s recent deal effectively undermined the whole ‘go direct to fans’ mantra, by hobbling its own iFollow product in favour of getting more inventory to Sky.

The premiums generated by an NFL-type inventory shake up is a way to maintain revenue levels in a downturn.

But…

The Scudamore Caveat

As Richard Scudamore told us recently, ‘I love America, but they’re flat earthers. They drive on the wrong side of the road’.

What he meant was that things are different over there. Simpler.

For one thing, The NFL doesn’t compete with UEFA.

In the rights marketplace, the Premier League has less room to flex because it runs in to UEFA’s ever expanding we’re here all week agenda.

The short term fix will be to release more games.

Meanwhile, fans face more subscriptions at higher prices, as the broadcasters seek to make back the rights fee.

See also: How Gen Z is killing sports media as we know it

Only 23% of Gen Zers say they’re passionate sports fans, compared to 42% of millennials, 33% of Gen Xers and 31% of baby boomers. Even more concerning, 27% of Gen Zers said they dislike sports altogether, compared with just 7% of millennials, 5% of Gen Xers and 6% of baby boomers. They’re bypassing traditional sports coverage entirely.

Where else to spend that $100million?

Spoiler: It doesn’t go far in F1.

Arctos has bought a quarter of Aston Martin F1, giving it the team a billion quid valuation.

Recently, RedBird Capital Partners led a €200 million deal for a 24% stake in Renault SA's Alpine Racing team, valuing it close to that Aston number.

Walled garden, limited number of teams, franchise price inflation.

That’s exactly what LIV, and now TGL, is trying to do in golf.

But it’s going less well.

TGL, the 21st century golf product, got cancelled this week for a very 19th century reason - the weather.

And over on LIV, the tech pitch from the Majesticks (the worst brand name in sports marketing), seems to be based on an iPad stuck to Ian Poulter’s golf bag.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Selling shovels in a gold rush

If TGL finally succeeds - and there’s much ESPN, and ESPN Bet, money riding on it - where’s the best place to put your $100million?

In a team franchise?

Or, is it a bet on the tech itself?

TGL is a golf simulator game with betting attached.

Of those three words - golf, betting and simulator - the latter is in danger of being overlooked.

Note: the market for golf simulators is v.bullish currently.

Covid gave the market a jolt.

Now there’s a race to get simulators in to homes; see the new mini version being touted by some of golf’s influencer class currently.

The next Peloton? Or the link between gaming and live sport.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

Style over content: sport’s relationship with the difficult problems

As pointed out by Nick Keller on this week’s podcast, there’s quite the gap between what sport says and what it does on things like climate action and other big, thorny societal challenges.

Meet the robot pushing at Infantino’s open door

Great idea from Dark Horses, in collaboration with Moya Dodd and Maggie Murphy.

It created some to and fro on WhatsUP.

Shit Idea of the Week

This piece of crap hit the UP inbox this week.

They even put the methodology in, like it would add a layer of credibility.

Thanks for your attention

Click the Like to make us more likeable.

Replacing courses with simulators would be golf walking the talk on climate action