Wedge Issues at The Open; Brand Bryson by numbers; What if Angel City is not a football club; McCormack Dassler World; Exclusivity and fear; Naomi in NY; Warm v Cold brands; City cliches

Overthinking the sports business, for money

Wedge Issues at The Open

I’ve been up at Troon this week, for my favourite sports event, The Open Championship.

And I was really pleased with the reception for Wedge Issues, our new golf business podcast, among the major players in the industry.

Monday night was a Callaway event, talking with Ben Sharpe the new CEO of the company, with CMO Chris Gregg. More on this conversation later, as Ben joins Wedge Issues for a future episode.

Tuesday night was the Association of Golf Writers (AGW) Dinner, a pre-Championship ritual, attended by anyone who is anyone in golf.

So a chance to chat with Jay Monahan, Guy Kinnings and Rick Shiels. Fair to say it’s a broad church.

Everyone is talking about LIV.

Or more accurately, the much rumoured ‘solution’ to the division that LIV has created in the game.

There was talk of a meeting of the five families this week.

Let’s see if an announcement is imminent.

LIV vs The idea of LIV

As mentioned previously, I’m not a fan of LIV Golf.

The execution has been weirdly off.

But the idea of it is important, because it’s the mineshaft canary for every major sport, including every Olympic discipline on show in Paris in a few weeks time.

A lot of airtime (including mine) is spent analysing the product - teams, format, prize money etc and the source of the money - Saudi, sportswashing etc.

But the bit of the puzzle that’s overlooked is the challenge LIV poses to the economic structure of the sports business.

And in particular, the concept of exclusivity.

The sports business has grown fat on the principle of exclusivity.

Since the days of McCormack and Dassler, sports marketing has been about the sale and then protection of IP.

And it’s worked brilliantly.

It powers the gravy train we’re all riding.

Very few asset classes have grown as far and fast as sports rights.

The protectionist mentality runs through sponsorship and media.

If Coke has bought the Olympics, Pepsi ain’t getting anywhere near it and vice versa (front of mind, as we’ve just done a podcast with the PepsiCo CMO Mark Kirkham).

If Sky has The Open, then why should they allow anyone else to film at Troon this week (I was told off by a steward for using the video function on my iPhone while watching Justin Thomas. The kindly old Scot apologised, but said he was protecting Sky’s rights…).

This exchange is just one of many moments of absurdity as the world created by McCormack and Dassler comes in to contact with the social media generation.

I particularly liked this sign, seen next to the practice ground at Troon.

(Btw, this is not a knock of Sky particularly. It does a brilliant job of covering golf via a really knowledgeable and engaging group of women presenters, mixed with some gnarled old tour pros who can dissect a swing fault at 200 yards - their coverage of the range this week was great, given there’s no actual competitive golf going on).

Meanwhile, Bryson Dechambeau has built the most interesting golf brand since Tiger Woods.

And here’s the kicker, I suspect Brand Bryson could never have happened without LIV.

We could attribute the reason for this at the freedom that LIV has given him, or more cynically, the absence of many LIV commercial and broadcast partners.

Either way, necessity mother of invention etc.

Bryson was a good golfer before he joined LIV.

Now he’s a YouTube creator with a personal brand and a fast growing and valuable audience.

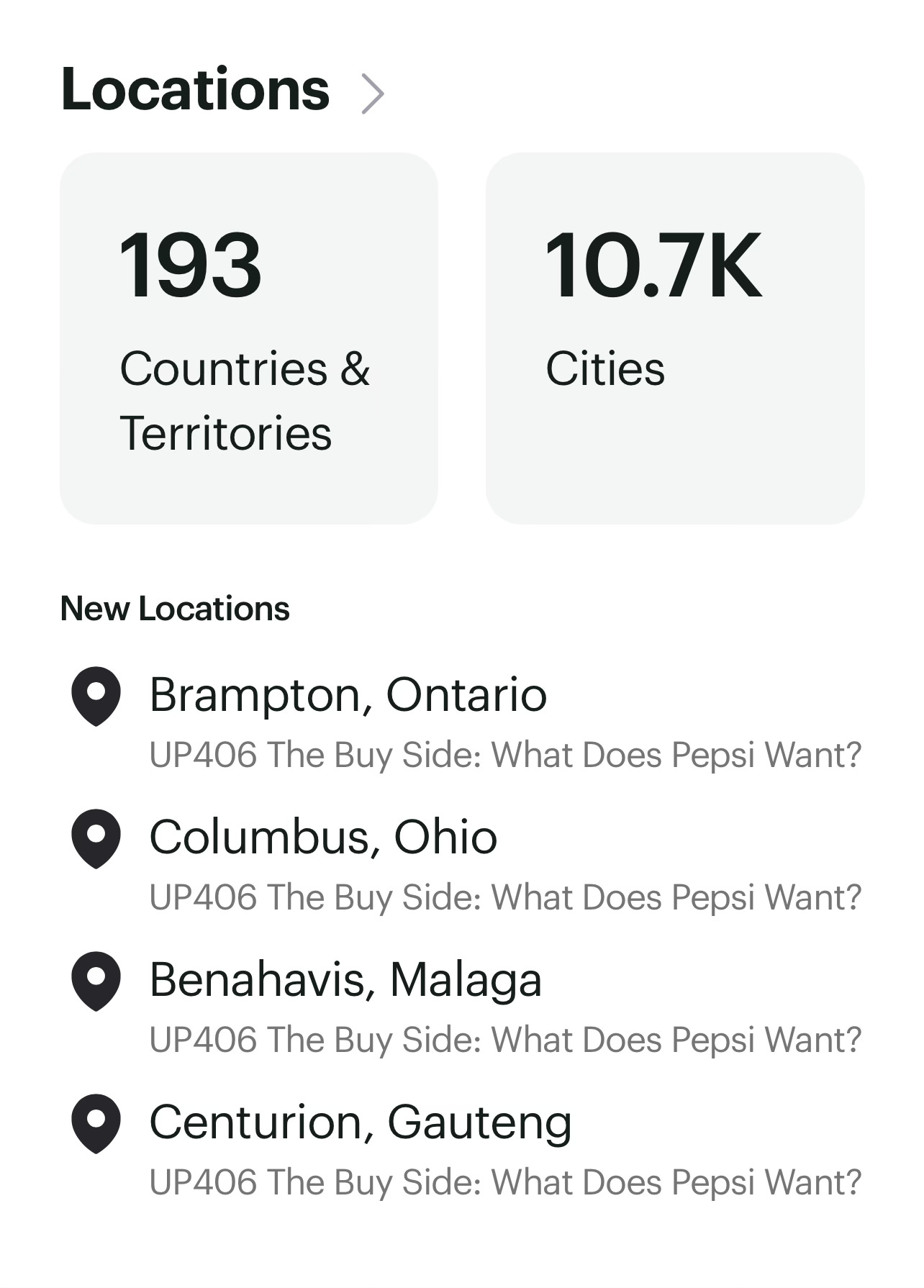

Our friends at KORE helped us frame the impact of Brand Bryson:

Follower Growth:

Bryson DeChambeau's followers increased by 84% YoY (from 1.9M to 3.5M).

TikTok saw the largest surge with a 224% increase (from 202.1K to 656.6K).

YouTube followers grew by 138% (from 346K to 825K).

Instagram followers grew by 71% (from 869K to 1.5M).

Comparisons:

Bryson ranks #45 in engagement among athletes in ball/stick sports, excluding global football.

He is the only golfer in the top 50, with Paige Spiranac at #56.

Over the last 365 days, Bryson had the most engagement (14.2M) and views (164.5M) compared to other world pros.

Summary

Bryson DeChambeau has significantly impacted the younger TikTok audience, evidenced by a 224% growth in followers and generating 7.8M engagements on the platform. This is fantastic news for the world of Golf. His dominance on TikTok, alongside substantial engagement on Instagram and YouTube, positions him as a leading figure in social media within the sports community, especially among younger demographics

The difference between a golfer and a brand

I saw the difference between a golfer and a creator this week, while sitting at the range, watching some of the best players in the world hitting balls.

Then appeared YouTube golf creator Peter Finch (who along with Rick Shiels, is 30% owned by Performance 54, now just 54, the agency synonymous with LIV).

Finch walked by, and all around me the phones came out.

It’s a different type of fame - creator and top golfer.

One is about entertainment (warm), the other is about performance (cold).

Bryson has managed to add the former to the latter.

Via YouTube, he’s gone from annoying, country club brat to something broader, more intelligent.

A couple of builds.

Fear is the dominant emotion of official broadcasters and sponsors

Fear of the exclusivity straitjacket permeates much of sports marketing, and is the antithesis of creativity.

It’s why everything tends to look the same.

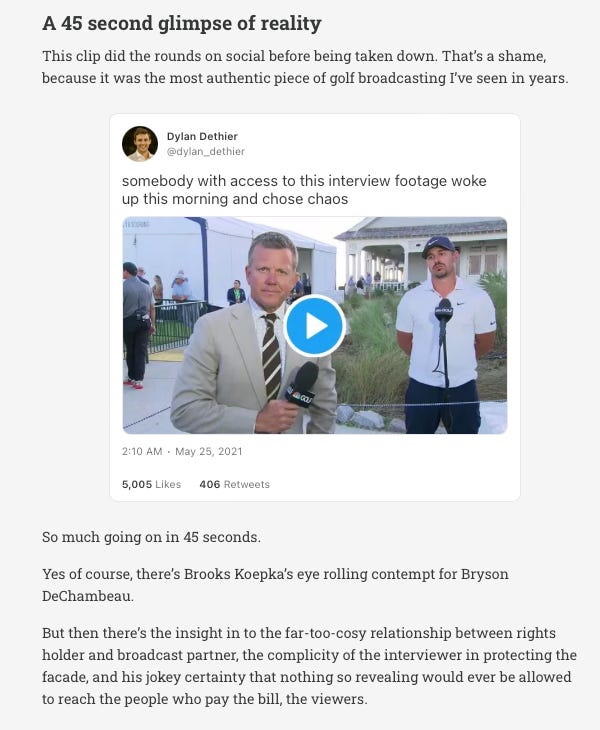

And as noted previously, the original Brooks Bryson Beef meme came from a clip that the official broadcast partner would’ve buried given the chance.

Creator fame is a protection against the fluctuations in performance

Which is a pretentious way of saying, people still talk about you when you’re losing. As looks like the case this morning at Troon.

Twitter, YouTube and TikTok are where golf is flying

By contrast, Full Swing, the official PGA TOUR Drive To Survive wannabe is a massive yawn. Driven by fear.

Here’s the Wedge Issues episode, with Rich Johnson and Carsten Thode.

What if, Angel City is not a football club?

What happened?

Bob Iger and Willow Bay have bought Angel City for $250million.

The assumption is that Angel City is a football club.

This takes the story in a certain direction, when it comes to the game of publicly guessing whether the new owners are seers or idiots. (A finance variant on The Leadership Myth binary of heroes and villains).

Angel City as Football Club takes you to revenue streams such as matchday, sponsorship and media rights projections.

That’s a very 1995 lens.

What if, the Igers have bought another business entirely.

What if, they see Angel City as a media entertainment property and/or apparel or product brand that just happens to have roots in soccer?

It’s the reverse of what Coke and Pepsi have been doing these last sixty years or more? They use sport to basically take our minds off the product.

How much marketing money would you need to spend to get the level of fame, community and brand achieved by Angel City’s founders Kara Norman, Natalie Portman and Julie Uhrman.

It puts a different frame on that 250 million.

But it also means the Angel City sale is not a bellwether for the value of women’s football more generally, which is a route that stories like this tend to follow.

There’s a growing number of women’s club MCO investor groups that want that story to continue.

But my hunch is that Angel City is about LA, Hollywood, powerful rich influential women. Tech, Silicon Valley.

Football is just the context.

And btw, brands like that don’t build themselves, which is what Todd Boehly and Jim Ratcliffe want/expect from their women’s teams.

It’s taken investment and focus. And money.

Talking of athlete creators…

Does Naomi Osaka actually play tennis anymore?

I suspect that yellow cabs are the New York version of the London Playbook.

See previous.

Other city-based sports marketing cliched genres welcome.

Who owns Seve?

Ballesteros was my idol.

So I’m vested in his name.

Saw this in The Open shop (was told off for taking the photo btw, bit of a theme of this newsletter).

I was wondering about the nuts and bolts of the brand. Can anyone tell me?

Lots of people want to know What Pepsi Wants?

New listeners seeking insight. Welcome all.

You can find the answer here.

Thanks for reading.

Till next Thursday.