What's the point of a minority stake; Foreign money tropes; But is it golf, pt2; Pre-approved barbarians; OPM WTF; Paris2024 TOPs v OKPs; Halves v Quarters; Inkjet Stadium

Overthinking the sports business, for money

This episode of Unofficial Partner is sponsored by We Are Sweet, helping you tell compelling stories in-the-moment, as they happen, from the heart of the action.

We Are Sweet captures live biometric data from athletes to uncover great stories, from the big occasions to subtle micro-moments you might not even know are taking place. These are crafted into captivating stories and transformed into stunning visuals ready for your broadcast, live event displays, and second-screen fan experiences, all in real-time.

From head-to-head heart rates to anticipated overtakes, We Are Sweet provides AI-driven insights to fuel conversations, inform bookmakers and predict future outcomes, all in the name of deepening fan engagement.

Enhance your audience’s understanding of the action like never before by using live data from We Are Sweet.

What’s the point of a minority stake?

What happened

New rules allow NFL teams to sell up to a 10% stake to a bunch of ‘pre-approved’ private equity firms.

These include Arctos Partners, Ares Management, Sixth Street, and a consortium including Blackstone, The Carlyle Group, CVC Capital Partners, and Dynasty Equity.

Note: These are not just P/E firms, they are NFL-approved P/E firms (adopts Marks and Spencer ad voice).

They can buy a 10% stake with no governing power or preferred equity agreements and a minimum lock-up period of six years.

By comparison, the MLB allows franchises to sell up to 30% of their equity to PE funds, and the NBA allows a single PE owner a 20% ownership cap.

An aside: if I'm a P/E firm NOT on that list, I’d be pretty pissed off, or blame my lobbyist, or just find someone to sue, given any ownership stake of an NFL team is guaranteed to go up in value irrespective of how it’s managed - see The Dan Snyder Effect:

So, it’s no wonder the ‘pre-approved’ barbarians are gathering at the gate.

Why do we care?

Minority stakes are a big theme across sport.

They turn up in various guises across several of-the-moment conversations, and they are what links The Hundred franchise auction, Jim Ratcliffe’s Man Utd adventure and the emergence of women-only multi-club investor groups, among others.

There’s a counterintuitive aspect to these stories, which is about the money and control, or lack of it.

P/E’s model assumes the application of organisational expertise, in addition to the money.

But what change can you affect from a minority position?

Given this context, it’s worth raising the question as to what does the money want?

(More money, obvs. But let’s pursue it a stage further).

What are the strategies at play and what is the impact on the way clubs and sports organisations operate, now and in the future?

Hear this week’s OPM, with Matt Rogan, Jonathan Lenson and Sam Johnson. The latter pairing from Milltown Partners.

Minority partnership vs Expensive season ticket

Not all minority partners are equal.

Just because you’ve bought a stake doesn’t mean you’re of use.

In fact, minority shareholders can very quickly clog up the system, overstaying their welcome like a drunk uncle at the Christmas party, clinging on waiting for something interesting to happen.

As Sam Johnson put it:

‘ Continental European football in particular is littered with people who have bought minority stakes thinking they were on the route to a majority, and then eight years down the line, they've got a very expensive season ticket’

Buying in to the room where it may or may not happen

Even billionaires baulk at buying the whole franchise.

But a small bit can get you influence, or the appearance of influence.

The fabled ‘room where it happens’.

Jonathan Lenson: ‘We obviously talk about it a lot in sport. It's one of the very few places in the world where there is both mass interest but there is also high level power and access, and influence that you can get from it.

At what point does a bunch of minorities turn into something major?

Seen in isolation, a P/E firm buying a minority share of the Dallas Cowboys is a bit meh.

But, Jonathan Lenson suggests another plan: minority partnerships as a route to an entry point for proven sports investors.

There's a third model where I guess Arctos are a good example of it, where they've been making a set of investments at minority stage in a set of different franchises across different sports. The assumption appears to be that creates something that you can then list because you might give the general investor access to an index effectively into sports, because I heard at the beginning, a fair bit of skepticism about, well, how do you get out?

Right? If you bought 10 percent or 20%, who wants that when they can't control? When I'm, you go to my numbers one and two, right? If you want influence or access and you parcel it up, that's one piece. But maybe instead of having five people owning three to 4%, you actually list an entity that gives people access to 30 or 40 different assets across the sports space.

There's still a question of how you get liquidity. Not just for the individuals behind the fund, but like in the individual properties, but that is different from a Jim Radcliffe in Manchester United or potentially what The Hundred might look like, where you might take people that are already committed to cricket, for example, as the initial reporting people that are in the IPL that see this as, just the next frontier of how to consolidate their interest and investments in the sport.

Foreign money, xenophobia and Gary Neville

Milltown Partners did a bit of focus grouping around attitudes to American investors in the Premier League.

Talk of money in sport often comes with a healthy dose of xenophobia attached.

American investors are a ‘clear and present danger to the pyramid’.

That’s how Gary Neville put it.

Likewise, the general conversation suggests Arab money is irrational, predicated on reputation building over traditional return on investment models.

And then there’s ‘Russian money’.

Half time oranges vs Quarterly reporting

Matt Rogan asked a good question on OPM: when we get down to it, does sport really fit the demands of the money markets?

This was picked up by friend of the podcast Stefan Borson.

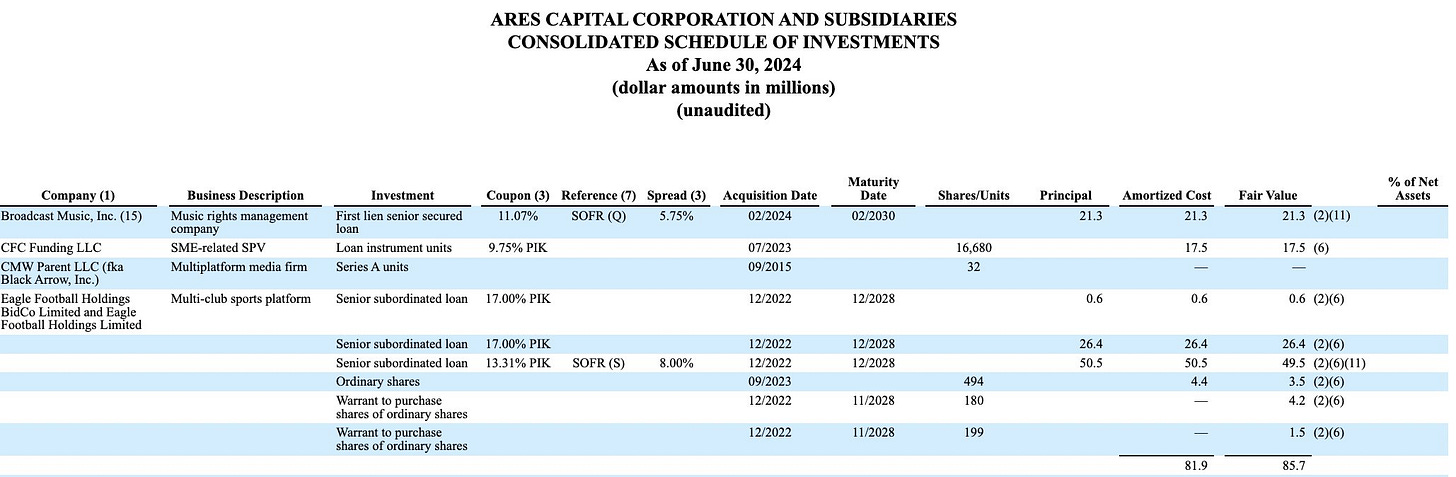

Stefan pointed to Ares Capital’s recent accounts, referencing John Textor’s Eagle Holdings, to which they’re lending at between 13% and 17%.

Interesting follow up to Stefan’s point on Twitter here.

‘London 2012 changed the world for disabled people’

A phrase you often hear.

Then Baroness Tanni Grey Thompson sent a message to the WhatsUP group:

But is it golf?

A build on previous note: Is Crazy Golf Golf?

For reasons we won’t go in to, I cycled around the Isle of Wight yesterday - electric bike, but still…

I came around a corner and there it was for all to see, the top of golf’s purchase funnel:

The latest IPSOS data for the PGA of Great Britain shows how reliant the game is on crazy (rebranded as ‘adventure’) golf to demonstrate participation growth.

Modern life is rubbish, pt245

TOPs v OKPs and nearly half from athlete posts

There’s nothing I like more than a post-Olympic sponsor performance table.

This top ten list from our mates at KORE Software is just a taster.

You’ll have to ask/beg them for the rest of the report.

One nugget that talks to the athlete as platform trend:

Even with the lOC sponsorship regulations limiting athletes to one branded post per partner, athletes still generated 45% of the total deliberate sponsorship value for brands.

Hear our recent podcast on what we learnt about Olympic marketing from Paris 2024.

Thanks for reading.

Share this newsletter with your friends and family.

And finally…

Now click the Fucking Like Button, I Mean How Fucking Hard Can It Fucking Be????

It’s the heart shaped thing below, you fucking bell end. It’s the lowest form of human-to-internet engagement and for reasons we don’t quite understand helps us appear more popular with people who don’t yet receive the newsletter, most of whom are of no value in and of themselves, but who collectively add to the story that this newsletter is popular among a group we’ve started to call industry insiders.

We’re grateful for your help in this matter.

I clicked the fucking like button. It wasn't hard. Now what?

I think you captured well the nuance between the overall "trend" and the actual vast differences in motivations among the members driving that trend and some of the obvious irony. Americans are a clear and present danger...but Americans have almost single handedly propped up the whole euro football pyramid over the last 5 years, because as Richard mentions in the pod, Europeans aren't interested buyers! Do the domestics know something that the foreigners don't? Reminds me when I was working with the Brazilians and we were buying really important manufacturing assets in the US from American owners and the ENTIRE board discussion was "those guys know a lot more than we do, so why are they selling and how are we getting fucked here?". We did the deal and the payback period was 2 years and EBITDA grew from 20MM to 600MM in 5 years. It's an M&A business school case study today. I have no idea how it's going to play out for all of the investors in European football but I am confident that it's not going to be the nationality of the investor that determines it.