The week that changed how Visa views sport

In this newsletter:

New pod: Episode 3 of The Buy Side, with Steve Day from Visa talking sport and sponsorship

Decoding Visa’s 35 year strategy, from the Olympics to UEFA, via FIFA and the NFL

Tottenham and the Super Bowl: sport’s role in normalising our cashless future

The marketing challenge: Invisible payments, invisible brands

A guide to decoupling and the rise of brand purpose

Plus: Simon Dent’s book choices; Unofficial alumni get together; and the quick way to get a big CMO job.

The Long Game - Visa and sport

Visa has been in and around major sport since becoming one of the second group of IOC partners, after Amex passed on renewing after LA1984 (each cycle of partners is known in Olympic circles by number, so this was TOP2 - see Timo Lumme Pod #112)

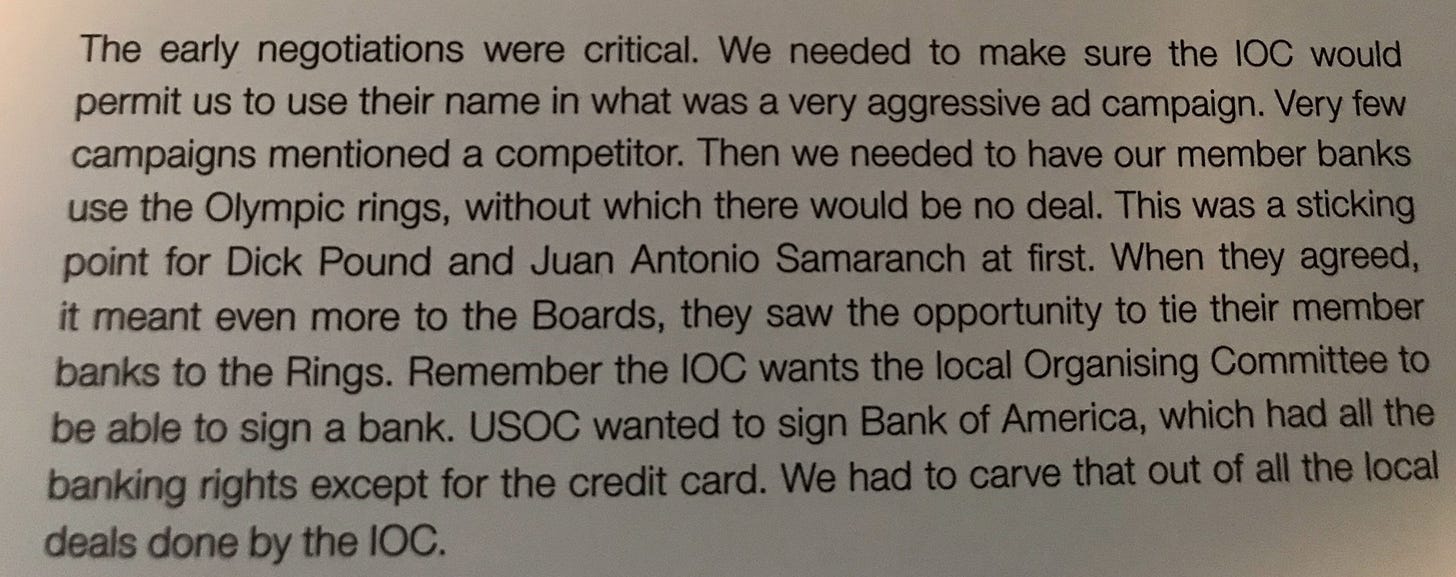

About ten years ago, I worked on a book with Shaun Whatling, the sage of sponsorship and CEO of Redmandarin. As part of this I interviewed John Bennett, one of the architects of Visa’s first IOC deal.

The nuts and bolts of the relationship were established early: The in-category competition (at this point Amex were the incumbents); pass through rights (meaning Visa’s partner banks were allowed access to IOC IP); and the importance to corporate ego within big sport sponsorships, aka ‘the company we keep’ (note the excitement of Visa’s name appearing next to Coke and GM in the passage below.

Note also the decision making levers at play in this next passage: The Board’s default use of TV media metrics as the frame to measure the Olympic sponsorship and how this framing rendered $17.5million a cost effective way of reaching a global audience, compared to running ad campaigns in every market.

But to fully understand Visa’s use of sport, you have to get your head around what a credit card really is, and by extension the role of the company in the financial services food chain. ‘Pass through rights’ help explain this. But it creates a problem for the right holder, in this case the IOC, because they always want to leave space in their portfolio for a bank, which in Olympic world is one of the main assets left for the local organising committee to exploit.

Cashless Sport - The near future of the card category

Fast forward to 2020 and all the above themes are still in play. But tech has brought new problems and challenges for Visa and its competitors, and this is reflected in how they use sport as a marketing platform.

Here’s a quick snapshot of the main players in today’s payment market.

One thing to note: Visa and Mastercard are incredibly profitable:

Sporting a near identical business model to Mastercard, Visa's network provides fast and safe transport for funds from a consumer to a merchant bank account after transactions. It does not lend money to its card holders, meaning that it also features an asset-light business model with an operating margin that even tops Mastercard's. In 2018, the fiscal year's adjusted operating margin came in at 66%.

(Note: The Visa v Mastercard rivalry in sport has sometimes led to the courts).

The companies in the graphic above are each set to reap a bonanza as we move towards cashless economies. Sport’s role will be in normalising this shift for a mainstream audience, a point that is now central to sponsor contracts with this valuable sector.

Steve Day:

The future of payments is cashless, and that’s why Visa has a huge advantage. In terms of sport, Tottenham’s cashless stadium is the first and is the future…fans don’t want to use cash, and the people who work in stadia don’t want to handle cash. It was moving that way anyway, and the last few months has accelerated that trend.

Steve mentioned a ‘new announcement’ during our conversation, which turned out to be the first ever ‘Cashless Super Bowl’, part of the negotiation for renewal with the NFL in 2019.

The accompanying release noted the upsides for both parties: a data grab for the rights holder and an uptick in match day revenue for the sponsor. And btw, have a look at how much more we spend when we pay by phone...

Visa found fans at live events spend 25% percent more when they are using contactless payments.

Switching to all-digital payments also will allow the NFL to collect more efficient data on consumer behaviour. Though Visa’s data doesn’t show what consumers purchase, Visa clients can see when, where, and how much consumers spend.

But, cashless brings Visa a problem too…

The more seamless our payment experience, the less we notice or care about the credit card brand that is allowing it all to happen.

Or, as Steve Day puts it:

As payment becomes more invisible, how do we remain salient?

Some heavy duty marketing challenges lie within that statement, most notably differentiation and purpose.

Can a credit card stand for anything beyond efficiency and how does the category defend itself against becoming commoditised? (This is a good backgrounder on the positioning strategies of the big three card brands).

Enter, women’s football

Visa signed up as partner of the UEFA Women’s Champions League and the UEFA Women’s European Championship, as well as the Women’s Under-19 and Under-17 tournaments, and the Women’s European Futsal Championship.

Visa has a rationale for sponsoring the IOC, FIFA, NFL from a B2B and B2C perspective. The UEFA women’s football deal is very different. That’s about the purpose of the Visa brand. The DNA of the Visa brand is ‘Everybody Everywhere’…it’s about acceptance, inclusion and equality and those qualities tap in directly to what women’s football is all about…we recognised we could make a difference as a brand if we invested in women’s football. We’d done a lot of strategic work in 2019, we came across the insights that women’s football is caught in vicious cycle - there wasn’t enough investment, therefore it wasn’t getting the coverage or the crowds, there weren’t enough players being developed - all of which meant the game wasn’t moving forward as quickly as it could have been. So we made a strategic decision that we wanted to break that cycle. We wanted to invest in women’s football because we could make a difference and change the sport.

How decoupling unlocked the value of women’s football

The decoupling, or unbundling, of women’s rights is a key trend. Deloitte’s research suggests that 60 per cent of top-flight women’s football clubs globally have front-of-shirt sponsors that are different to the men’s equivalent. The findings are based on information from the 2018/19 season and Deloitte expects that the proportion of teams with distinct main sponsors to rise to 100 per cent by the time of the 2023 Women’s World Cup.

At that time UEFA was looking to decouple their men’s and women’s rights, so we became the first sponsor to support women’s football at the back end of 2019. UEFA had sold the men’s and women’s rights together. What happened was that brands bought the men’s rights and the women’s game was thrown in as an add-on. But those brands weren’t really thinking about how they could help grow the women’s game. When UEFA decoupled, we made a pledge that we were only interested in the women’s rights, because it tied in to a much broader agenda within Visa. Women’s football became the perfect platform to do that.

Something went right: From first meeting to CEO sign off in a week:

It was the easiest internal sell for a sponsorship I’ve ever had. I went to Leaders at Chelsea in 2018, had a conversation with a guy called Peter Willems from UEFA, on a Thursday, saying Visa were interested in just taking the women’s rights. At nine o’clock the next morning I met with their agency, TRM’s Leo Thompson, and had a conversation. On Monday morning they came in to Visa for a conversation with my boss. On the Friday of that week we had a deal agreed, signed off by Visa’s Global Chief Executive…a week from initial conversations to sign off by the global CEO. That never happens in big companies…the lead time is usually months of backwards and forwards, justifications and modelling etc, but because this was seen as the right thing to do it became an easy sell.

We knew we were investing ahead of the curve, and the eyeballs wouldn’t be there, but we’re confident they will grow. We wanted to be part of the solution to help that growth.

By moving early, Visa can position their partnership with the UEFA Women’s Euros as a purpose play. The language used has echoes of traditional sponsorship language of patronage: ‘support’, ‘grow the game’ etc. It’s good news for the rights holder too, as UEFA has carved out a third payment card partnership across its portfolio - Mastercard sponsors the Champions League and Alipay the men’s Euros.

A less rational, more emotional decision making process? Maybe…

Visa’s UEFA deal seems to upgrade the intangible value of the partnership over the purely business ROI that has defined the company’s sport strategy since that first IOC deal in 1986.

Sponsorship decision making is always a fight between business and brand: the rational spreadsheet number crunching v the more personal, human bit - the ego and the hunch.

The story of Visa’s UEFA deal feels significant, particularly for rights holders seeking to sell to big corporates, who have huge name awareness but whose brands often lack warmth and trust.

It took UEFA (via TEAM and TRM) just a week to get a purpose deal over the line, compared to months of slogging through data arguments aimed at intellectual decision making processes. Surely that’s a sign of something?

I asked Steve Day if this marked a change of approach. He was sceptical.

We are bombarded with sponsorship proposals. Some are evaluated on reach, frequency and payback. Others on more purpose driven metrics. It depends…

Finally

How many of Simon Dent’s Top Ten favourite sports books have you read?

When UP guests collide: News reaches us of a collaboration between two recent Unofficial podcast alumni, Joymo and FiftyThree-Six. We’re glad to have helped put them together, Sean’s getting a hat. (This is a Cilla Black reference, if you happen to be Gen Y, just Google it).

Wanna posh new job? Come on the UP podcast…first Ben Carter (Pod #110) went from Just Eat to Purplebricks after appearing with us, now TSB’s Pete Markey has got a new CMO gig at Boots. And that’s before we get on to Nathan Homer…

If you liked our conversation with Steve Day of Visa, you should check out The Buy Side back catalogue, click the image.

Enjoy this newsletter?

Be like regular listener Lona Price Jones and subscribe to the Unofficial Partner podcast and sign up to this newsletter and spread the word on social media..

Follow @RichardGillis1 and @PaulPingles (the ill-judged Twitter handle of Sean Singleton, the UP co-founder).

Join the 80 or more people who’ve left gushing five star reviews on Apple Podcasts - click the link to add your view.